B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm constructing a new manufacturing plant and financing it with short-term loans,which are scheduled to be converted to first mortgage bonds when the plant is completed,would want to separate the construction loan from its current liabilities associated with working capital when calculating net working capital.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A revolving credit agreement is a formal line of credit.The firm must generally pay a fee on the unused balance of the committed funds to compensate the bank for the commitment to extend those funds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Edison Inc.has annual sales of $37,595,000,or $103,000 a day on a 365-day basis.The firm's cost of goods sold are 75% of sales.On average,the company has $9,000,000 in inventory and $8,000,000 in accounts receivable.The firm is looking for ways to shorten its cash conversion cycle.Its CFO has proposed new policies that would result in a 20% reduction in both average inventories and accounts receivable.She also anticipates that these policies would reduce sales by 10%,while the payables deferral period would remain unchanged at 35 days.What effect would these policies have on the company's cash conversion cycle? Do not round intermediate calculations.Round to the nearest whole day.

A) -24 days

B) -20 days

C) -25 days

D) -22 days

E) -21 days

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firms generally choose to finance temporary current assets with short-term debt because

A) matching the maturities of assets and liabilities reduces risk under some circumstances,and also because short-term debt is often less expensive than long-term capital.

B) short-term interest rates have traditionally been more stable than long-term interest rates.

C) a firm that borrows heavily on a long-term basis is more apt to be unable to repay the debt than a firm that borrows short term.

D) the yield curve is normally downward sloping.

E) short-term debt has a higher cost than equity capital.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

One of the effects of ceasing to take trade credit discounts is that the firm's accounts payable will rise,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Margetis Inc.carries an average inventory of $750,000.Its annual sales are $10 million,its cost of goods sold are 75% of annual sales,and its receivables collection period is twice as long as its inventory conversion period.The firm buys on terms of net 30 days,and it pays on time.Its new CFO wants to decrease the cash conversion cycle by 6 days,based on a 365-day year.He believes he can reduce the average inventory to $635,450 with no effect on sales.By how much must the firm also reduce its accounts receivable to meet its goal in the reduction of its cash conversion cycle? Do not round your intermediate calculations.

A) $11,650

B) $11,767

C) $13,398

D) $13,980

E) $11,417

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Other things held constant,the higher a firm's days sales outstanding (DSO) ,the better its credit department.

B) If a firm that sells on terms of net 30 changes its policy to 2/10,net 30,and if no change in sales volume occurs,then the firm's DSO will probably increase.

C) If a firm sells on terms of 2/10,net 30,and its DSO is 30 days,then the firm probably has some past due accounts.

D) If a firm sells on terms of net 60,and if its sales are highly seasonal,with a sharp peak in December,then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in January than in July.

E) If a firm changed the credit terms offered to its customers from 2/10,net 30 to 2/10,net 60,then its sales should increase,and this should lead to an increase in sales per day,and that should lead to a decrease in the DSO.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Aggarwal Inc.buys on terms of 2/10,net 30,and it always pays on the 30th day.The CFO calculates that the average amount of costly trade credit carried is $425,000.What is the firm's average accounts payable balance? Assume a 365-day year.

A) $707,625

B) $516,375

C) $637,500

D) $567,375

E) $522,750

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The calculated cost of trade credit can be reduced by paying late.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

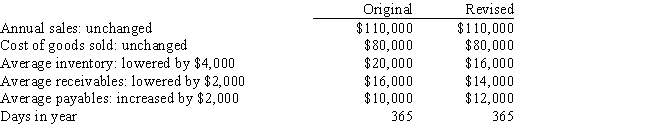

Zervos Inc.had the following data for last year (in millions) .The new CFO believes (1) that an improved inventory management system could lower the average inventory by $4,000, (2) that improvements in the credit department could reduce receivables by $2,000,and (3) that the purchasing department could negotiate better credit terms and thereby increase accounts payable by $2,000.Furthermore,she thinks that these changes would not affect either sales or the costs of goods sold.If these changes were made,by how many days would the cash conversion cycle be lowered? Do not round your intermediate calculations.

A) 37.41 days

B) 28.57 days

C) 37.75 days

D) 34.01 days

E) 25.51 days

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Since receivables and payables both result from sales transactions,a firm with a high receivables-to-sales ratio must also have a high payables-to-sales ratio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A line of credit can be either a formal or an informal agreement between a borrower and a bank regarding the maximum amount of credit the bank will extend to the borrower during some future period,assuming the borrower maintains its financial strength.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant,which of the following will cause an increase in net working capital?

A) Cash is used to buy marketable securities.

B) A cash dividend is declared and paid.

C) Merchandise is sold at a profit,but the sale is on credit.

D) Long-term bonds are retired with the proceeds of a preferred stock issue.

E) Missing inventory is written off against retained earnings.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The cash budget and the capital budget are handled separately,and although they are both important,they are developed completely independently of one another.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Setting up a lockbox arrangement is one way for a firm to speed up the collection of payments from its customers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm buys on terms of 2/8,net 45 days,it does not take discounts,and it actually pays after 63 days.What is the effective annual percentage cost of its non-free trade credit? (Use a 365-day year. )

A) 14.35%

B) 12.48%

C) 14.06%

D) 17.79%

E) 11.19%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's peak borrowing needs will probably be overstated if it bases its monthly cash budget on the assumption that both cash receipts and cash payments occur uniformly over the month but in reality payments are concentrated at the beginning of each month.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm sells on terms of 2/10,net 30 days,and its DSO is 28 days,then the fact that the 28-day DSO is less than the 30-day credit period tell us that the credit department is functioning efficiently and there are no past due accounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant,which of the following would tend to reduce the cash conversion cycle?

A) Carry a constant amount of receivables as sales decline.

B) Place larger orders for raw materials to take advantage of price breaks.

C) Take all discounts that are offered.

D) Continue to take all discounts that are offered and pay on the net date.

E) Offer longer payment terms to customers.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 124

Related Exams