A) current liability

B) owner's equity

C) long-term liability

D) current liability or long-term liability, depending upon when the pension liability is to be paid

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In order to be a recorded contingent liability, the liability must be possible and easily estimated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Notes may be issued

A) when assets are purchased

B) to creditor's to temporarily satisfy an account payable created earlier

C) when borrowing money

D) all of the above

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A pension plan which promises employees a fixed annual pension benefit, based on years of service and compensation, is called a(n)

A) defined contribution plan

B) defined benefit plan

C) unfunded plan

D) compensation plan

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

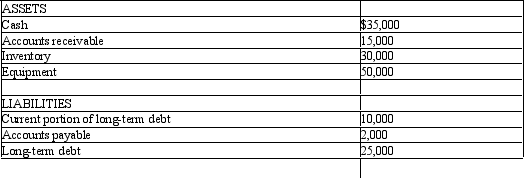

The Crafter Company had the following assets and liabilities as of December 31, 2012:  Determine the quick ratio for the end of the year (rounded to one decimal point) .

Determine the quick ratio for the end of the year (rounded to one decimal point) .

A) 6.7

B) 13.0

C) 4.2

D) 3.5

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a borrower receives the face amount of a discounted note less discount, this amount is known as:

A) the note proceeds

B) the note discount

C) the note deferred interest

D) the note principal

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following forms is typically given to employees at the end of the calendar year so that employees can file their individual income tax forms?

A) Employee's Withholding Allowance Certificate (W-4)

B) Wage and Tax Statement (Form W-2)

C) Employer's Quarterly Federal Tax Return (Form 941)

D) 401k plans

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following taxes would be deducted in determining an employee's net pay?

A) FUTA taxes

B) SUTA taxes

C) FICA taxes

D) all of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

An employee earns $40 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. Assume that the employee worked 60 hours during the week, and that the gross pay prior to the current week totaled $58,000. Assume further that the social security tax rate was 7.0% (on earnings up to $100,000), the Medicare tax rate was 1.5%, and the federal income tax to be withheld was $614. Required: (1) Determine the gross pay for the week. (2) Determine the net pay for the week.

Correct Answer

verified

Correct Answer

verified

Showing 161 - 169 of 169

Related Exams