A) Treasury Stock for $8,500

B) Paid-In Capital from Treasury Stock for $8,500

C) Paid-In Capital in Excess of Par/Common for $2,900

D) Paid-In Capital from Treasury Stock for $2,900

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The balance in Retained Earnings at the end of the period is created by closing entries.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

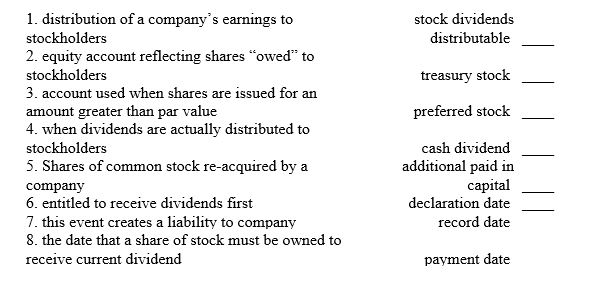

Match the following stockholder's equity concepts to the best answer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

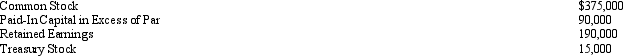

What is the total stockholders' equity based on the following account balances?

A) $670,000

B) $655,000

C) $640,000

D) $565,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

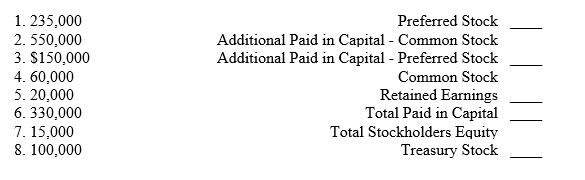

Match the value to the appropriate account. For the year ended 2012 ABC had the following transactions:

- issued 10,000 shares of $2.00 par value common stock for $12.00 per share

- issued 3,000 shares of $50 par value 6% preferred stock for $70 per share

- purchased 1000 shares of previously issued common stock for $15.00 per share

-reported net income of $200,000

- declared and paid a total dividend of $40,000

Assume that retained earnings had a beginning balance of $75,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation has 50,000 shares of $25 par value stock outstanding that has a current market value of $150. If the corporation issues a 5-for-1 stock split, the market value of the stock after the split will be approximately:

A) $25

B) $150

C) $5

D) $30

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Par value

A) is the monetary value assigned per share in the corporate charter.

B) represents what a share of stock is worth.

C) represents the original selling price for a share of stock.

D) is established for a share of stock after it is issued.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term deficit is used to refer to a debit balance in which of the following accounts of a corporation?

A) Retained Earnings

B) Treasury Stock

C) Organizational Expenses

D) Common Stock

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The par value of common stock must always be equal to its market value on the date the stock is issued.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following would not be considered an advantage of the corporate form of organization?

A) Government regulation

B) Separate legal existence

C) Continuous life

D) Limited liability of stockholders

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation purchased 1,000 shares of its $5 par common stock at $10 and subsequently sold 500 of the shares at $20. What is the amount of revenue realized from the sale?

A) $0

B) $5,000

C) $2,500

D) $10,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the dividend amount of preferred stock, $50 par value, is quoted as 8%, then the dividends per share would be $4.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Vincent Corporation has 100,000 share of $100 par common stock outstanding. On June 30, Vincent Corporation declared a 5% stock dividend to be issued on July 30 to stockholders of record July 15. The market price of the stock was $132 a share on June 30. Journalize the entries required on June 30, July 15 and July 30.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true of a corporation?

A) It may enter into binding legal contracts in its own name.

B) It may sue and be sued.

C) The acts of its owners bind the corporation.

D) It may buy, own, and sell property.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record the issuance of 150 shares of $5 par common stock at par to an attorney in payment of legal fees for organizing the corporation includes a credit to

A) Organizational Expenses

B) Goodwill

C) Common Stock

D) Cash

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary purpose of a stock split is to

A) increase paid-in capital

B) reduce the market price of the stock per share

C) increase the market price of the stock per share

D) increase retained earnings

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following amounts should be disclosed in the stockholders' equity section of the balance sheet?

A) the number of shares of common stock outstanding

B) the number of shares of common stock issued

C) the number of shares of common stock authorized

D) all of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Organizational expenses are classified as intangible assets on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A restriction/appropriation of retained earnings establishes cash assets that are set aside for a specific purpose.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

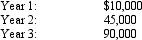

Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends:

Determine the dividends per share for preferred and common stock for each year.

Determine the dividends per share for preferred and common stock for each year.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 165

Related Exams