A) $370,000

B) $790,000

C) $80,000

D) $290,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

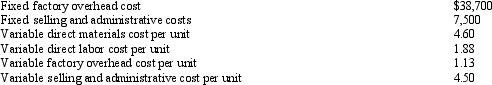

Falcon Inc. manufactures Product B, incurring variable costs of $15.00 per unit and fixed costs of $70,000. Falcon desires a profit equal to a 12% rate of return on assets, $785,000 of assets are devoted to producing Product B, and 100,000 units are expected to be produced and sold.

Round your intermediate calculations and final answer to two decimal places.

Round your intermediate calculations and final answer to two decimal places.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that Penguin Co. is considering disposing of equipment that cost $50,000 and has $40,000 of accumulated depreciation to date. Penguin Co. can sell the equipment through a broker for $25,000 less 5% commission. Alternatively, Teal Co. has offered to lease the equipment for five years for a total of $48,750. Penguin will incur repair, insurance, and property tax expenses estimated at $10,000. At lease-end, the equipment is expected to have no residual value. The net differential income from the lease alternative is:

A) $15,000

B) $ 5,000

C) $25,000

D) $12,500

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

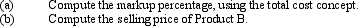

Magpie Corporation uses the total cost concept of product pricing. Below is cost information for the production and sale of 60,000 units of its sole product. Magpie desires a profit equal to a 25% rate of return on invested assets of $700,000.  The markup percentage on total cost for the company's product is:

The markup percentage on total cost for the company's product is:

A) 21.0%

B) 22.7%

C) 15.8%

D) 24.0%

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A practical approach which is frequently used by managers when setting normal long-run prices is the cost-plus approach.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mighty Safe Fire Alarm is currently buying 50,000 motherboard from MotherBoard, Inc. at a price of $65 per board. Mighty Safe is considering making its own boards. The costs to make the board are as follows: Direct Materials $32 per unit, Direct labor $10 per unit, Variable Factory Overhead $16.00, Fixed Costs for the plant would increase by $75,000. Which option should be selected and why?

A) Buy - $75,000 more in profits

B) Make - $275,000 increase in profits

C) Buy - $275,000 more in profits

D) Make - $350,000 increase in profits

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Hill Co. can further process Product O to produce Product P. Product O is currently selling for $60 per pound and costs $42 per pound to produce. Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce. The differential cost of producing Product P is $55 per pound.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Widgeon Co. manufactures three products: Bales; Tales; and Wales. The selling prices are: $55; $78; and $32, respectively. The variable costs for each product are: $20; $50; and $15, respectively. Each product must go through the same processing in a machine that is limited to 2,000 hours per month. Bales take 5 hours to process, Tales take 7 hours, and Wales take 1 hour. Assuming that Widgeon Co. can sell all of the products they can make, what is the maximum contribution margin they can earn per month?

A) $49,000

B) $70,000

C) $56,000

D) $34,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following reasons would cause a company to reject an offer to accept business at a special price?

A) The additional sale will not conflict with regular sales.

B) The additional sales will increase differential income.

C) The additional sales will not increase fixed expenses.

D) The additional sales will increase fixed expenses.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

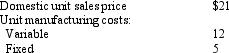

A business received an offer from an exporter for 20,000 units of product at $15 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available:  What is the differential revenue from the acceptance of the offer?

What is the differential revenue from the acceptance of the offer?

A) $300,000

B) $420,000

C) $120,000

D) $240,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Widgeon Co. manufactures three products: Bales; Tales; and Wales. The selling prices are: $55; $78; and $32, respectively. The variable costs for each product are: $20; $50; and $15, respectively. Each product must go through the same processing in a machine that is limited to 2,000 hours per month. Bales take 5 hours to process, Tales take 7 hours, and Wales take 1 hour. What is the contribution margin per machine hour for Tales?

A) $4

B) $7

C) $28

D) $35

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

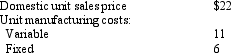

A business received an offer from an exporter for 30,000 units of product at $16 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available:  What is the differential cost from the acceptance of the offer?

What is the differential cost from the acceptance of the offer?

A) $120,000

B) $330,000

C) $300,000

D) $510,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

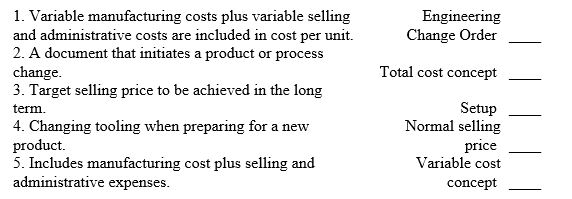

Match each of the following terms with the best definition given.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following should be considered in a make or buy decision except

A) cost savings

B) quality issues with the supplier

C) future growth in the plant and other production opportunities

D) whether the supplier will make a profit that would no longer belong to the business

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A practical approach which is frequently used by managers when setting normal long-run prices is the:

A) cost-plus approach

B) economic theory approach

C) price graph approach

D) price skimming

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Ptarmigan Company produces two products. Product A has a contribution margin of $20 and requires 4 machine hours. Product B has a contribution margin of $18 and requires 3 machine hours. Determine the most profitable product assuming the machine hours are the constraint.

Correct Answer

verified

Correct Answer

verified

True/False

Cost plus methods determine the normal selling price by estimating a cost amount per unit and adding a markup.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Lockrite Security Company manufacturers home alarms. Currently it is manufacturing one of its components at a total cost of $45 which includes fixed costs of $15 per unit. An outside provider of this component has offered to sell them the component for $40. Provide a differential analysis of the outside purchase proposal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

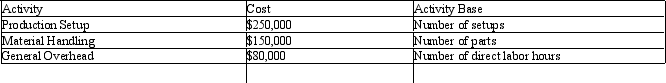

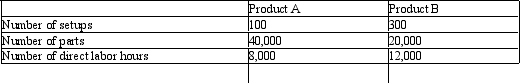

Miramar Industries manufactures two products, A and B The manufacturing operation involves three overhead activities - production setup, material handling, and general factory activities. Miramar uses activity-based costing to allocate overhead to products. An activity analysis of the overhead revealed the following estimated costs and activity bases for these activities:  Each product's total activity in each of the three areas are as follows:

Each product's total activity in each of the three areas are as follows:

What is the activity rate for Material Handling?

What is the activity rate for Material Handling?

A) $1.50 per part

B) $3.75 per part

C) $7.50 per part

D) $2.50 per part

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Hill Co. can further process Product O to produce Product P. Product O is currently selling for $60 per pound and costs $42 per pound to produce. Product P would sell for $82 per pound and would require an additional cost of $13 per pound to produce. The differential cost of producing Product P is $13 per pound.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 162

Related Exams