A) $655

B) $620

C) $690

D) $659

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

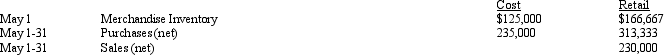

On the basis of the following data, what is the estimated cost of the merchandise inventory on May 31 using the retail method?

A) $250,000

B) $360,000

C) $172,500

D) $187,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Of the three widely used inventory costing methods (FIFO, LIFO, and average cost), the LIFO method of costing inventory assumes costs are charged based on the most recent purchases first.

B) False

Correct Answer

verified

Correct Answer

verified

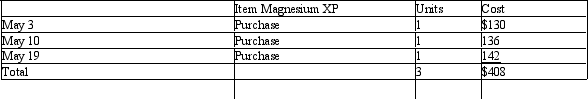

Essay

Three identical units of Item Magnesium XP are purchased during May, as shown below.

Assume that two units are sold on May 23 for $313. Determine the gross profit for May and ending inventory on May 31 using (a) FIFO, (b) LIFO, and (c) average cost methods.

Assume that two units are sold on May 23 for $313. Determine the gross profit for May and ending inventory on May 31 using (a) FIFO, (b) LIFO, and (c) average cost methods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the _________ inventory method, accounting records maintain a continuously updated inventory value.

A) retail

B) periodic

C) physical

D) perpetual

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

During periods of increasing costs, the use of the FIFO method of costing inventory will yield an inventory amount for the balance sheet that is higher than LIFO would produce.

B) False

Correct Answer

verified

Correct Answer

verified

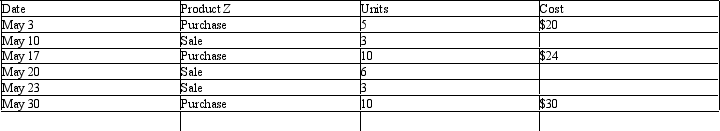

Multiple Choice

Use the following information to answer the following questions. The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

Assuming that the company uses the perpetual inventory system, determine the Gross Profit for the month of May using the LIFO cost method

Assuming that the company uses the perpetual inventory system, determine the Gross Profit for the month of May using the LIFO cost method

A) $348

B) $452

C) $444

D) $356

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In valuing damaged merchandise for inventory purposes, net realizable value is the estimated selling price less any direct costs of disposal.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Inventory controls start when the merchandise is shelved in the store area.

B) False

Correct Answer

verified

Correct Answer

verified

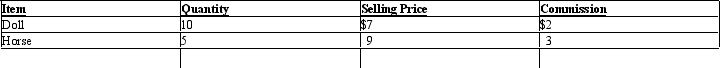

Essay

Determine the total value of the merchandise using Net Realizable Value:

Correct Answer

verified

Correct Answer

verified

True/False

The lower-of-cost-or-market method of determining the value of ending inventory can be applied on an item by item, by major classification of inventory, or by the total inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

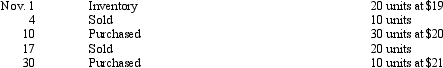

The inventory data for an item for November are:  Using a perpetual system, what is the cost of the merchandise sold for November if the company uses FIFO?

Using a perpetual system, what is the cost of the merchandise sold for November if the company uses FIFO?

A) $610

B) $600

C) $590

D) $580

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

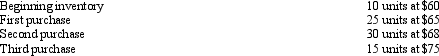

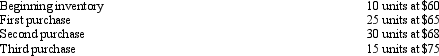

The following lots of a particular commodity were available for sale during the year:  The firm uses the periodic system and there are 25 units of the commodity on hand at the end of the year.

What is the amount of the inventory at the end of the year using the FIFO method?

The firm uses the periodic system and there are 25 units of the commodity on hand at the end of the year.

What is the amount of the inventory at the end of the year using the FIFO method?

A) $1,685

B) $1,575

C) $1,805

D) $3,585

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

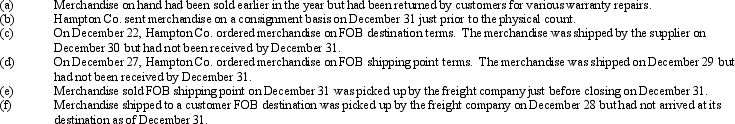

Hampton Co. took a physical count of its inventory on December 31. In addition, it had to decide whether or not the following items should be added to this count.

Indicate which items should be added to (answer: yes) and which items should not be added to (answer: no) the December 31 inventory count.

Indicate which items should be added to (answer: yes) and which items should not be added to (answer: no) the December 31 inventory count.

Correct Answer

verified

Correct Answer

verified

True/False

If the perpetual inventory system is used, the account entitled Merchandise Inventory is debited for purchases of merchandise.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following lots of a particular commodity were available for sale during the year:  The firm uses the periodic system and there are 25 units of the commodity on hand at the end of the year.

What is the amount of the inventory at the end of the year using the average cost method?

The firm uses the periodic system and there are 25 units of the commodity on hand at the end of the year.

What is the amount of the inventory at the end of the year using the average cost method?

A) $1,685

B) $1,575

C) $1,805

D) $3,705

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

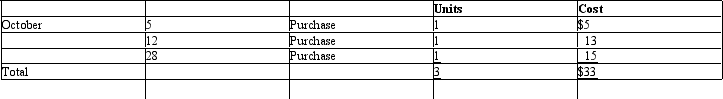

Assume that three identical units of merchandise are purchased during October, as follows:

Assume one unit is sold on October 31 for $28. Determine Cost of Merchandise Sold, Gross Profit, and Ending Inventory under the Average Cost method.

Assume one unit is sold on October 31 for $28. Determine Cost of Merchandise Sold, Gross Profit, and Ending Inventory under the Average Cost method.

Correct Answer

verified

Correct Answer

verified

True/False

During periods of increasing costs, the use of the FIFO method of costing inventory will result in a greater amount of net income than would result from the use of the LIFO cost method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taking a physical count of inventory

A) is not necessary when a periodic inventory system is used

B) should be done near year-end

C) has no internal control relevance

D) is not necessary when a perpetual inventory system is used

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Too much inventory on hand

A) reduces solvency

B) increases the cost to safeguard the assets

C) increases the losses due to price declines

D) all of the above

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 165

Related Exams