A) less than 25 units

B) 25 units

C) between 25 units and 50 units

D) greater than 50 units

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

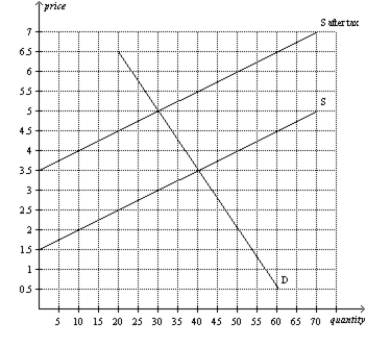

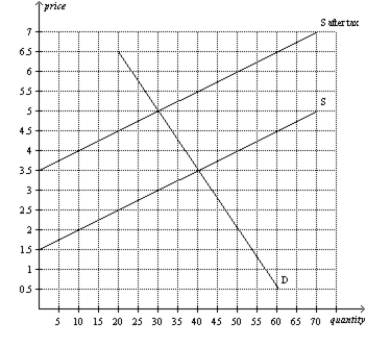

Figure 6-22  -Refer to Figure 6-22.The amount of the tax per unit is

-Refer to Figure 6-22.The amount of the tax per unit is

A) $2.00.

B) $1.50.

C) $3.00.

D) $0.50.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the buyers of personal computer external hard drives encourages

A) sellers to supply a smaller quantity at every price.

B) buyers to demand a smaller quantity at every price.

C) buyers to demand a larger quantity at every price.

D) Both a) and b) are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

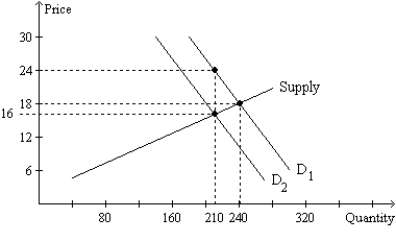

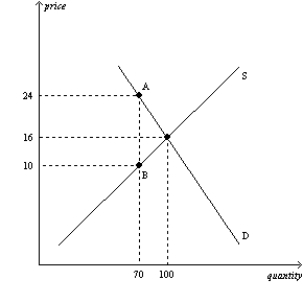

Figure 6-24  -Refer to Figure 6-24.The price paid by buyers after the tax is imposed is

-Refer to Figure 6-24.The price paid by buyers after the tax is imposed is

A) $24.

B) $21.

C) $18.

D) $16.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in a particular market,the supply curve is highly elastic and the demand curve is highly inelastic.If a tax is imposed in this market,then the

A) buyers will bear a greater burden of the tax than the sellers.

B) sellers will bear a greater burden of the tax than the buyers.

C) buyers and sellers are likely to share the burden of the tax equally.

D) buyers and sellers will not share the burden equally,but it is impossible to determine who will bear the greater burden of the tax without more information.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

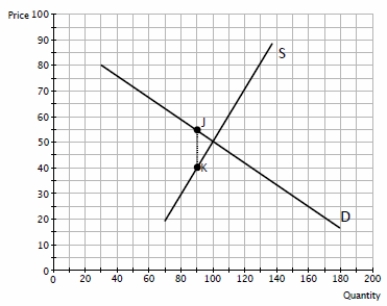

Figure 6-33

The diagram shows the effect of a tax as measured by the distance between J and K.  -Refer to Figure 6-33.Based upon the diagram,

-Refer to Figure 6-33.Based upon the diagram,

A) more of the incidence of the tax is on buyers,since the demand curve is more elastic than the supply curve.

B) more of the incidence of the tax is on sellers,since the demand curve is less elastic than is the supply curve .

C) more of the incidence of the tax is on sellers,since supply is more inelastic than demand.

D) more of the incidence of the tax is on buyers,since supply is more inelastic than demand.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the buyers of cameras encourages

A) sellers to supply a smaller quantity at every price.

B) buyers to demand a smaller quantity at every price.

C) sellers to supply a larger quantity at every price.

D) Both a) and b) are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that a tax is placed on books.If the buyers pay the majority of the tax,then we know that the

A) demand is more inelastic than the supply.

B) supply is more inelastic than the demand.

C) government has required that buyers remit the tax payments.

D) government has required that sellers remit the tax payments.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a $40 tax on the buyers of refrigerators.The tax would

A) shift the demand curve downward by less than $40.

B) raise the equilibrium price by $40.

C) create a $20 tax burden each for buyers and sellers.

D) discourage market activity.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

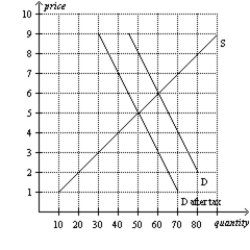

Figure 6-25  -Refer to Figure 6-25.Suppose the same supply and demand curves apply,and a tax of the same amount per unit as shown here is imposed.Now,however,the sellers of the good,rather than the buyers,are required to pay the tax to the government.After the sellers are required to pay the tax,relative to the case depicted in the graph,the burden on buyers will be

-Refer to Figure 6-25.Suppose the same supply and demand curves apply,and a tax of the same amount per unit as shown here is imposed.Now,however,the sellers of the good,rather than the buyers,are required to pay the tax to the government.After the sellers are required to pay the tax,relative to the case depicted in the graph,the burden on buyers will be

A) larger,and the burden on sellers will be smaller.

B) smaller,and the burden on sellers will be larger.

C) the same,and the burden on sellers will be the same.

D) The relative burdens in the two cases cannot be determined without further information.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government levies a $5 tax per ticket on buyers of NFL game tickets,then the price paid by buyers of NFL game tickets would

A) increase by less than $5.

B) increase by exactly $5.

C) increase by more than $5.

D) decrease by an indeterminate amount.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-22  -Refer to Figure 6-22.As the figure is drawn,who sends the tax payment to the government?

-Refer to Figure 6-22.As the figure is drawn,who sends the tax payment to the government?

A) The buyers send the tax payment.

B) The sellers send the tax payment.

C) A portion of the tax payment is sent by the buyers,and the remaining portion is sent by the sellers.

D) The question of who sends the tax payment cannot be determined from the graph.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

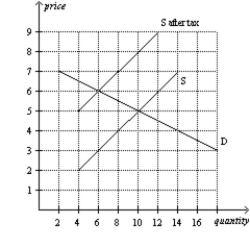

Figure 6-23  -Refer to Figure 6-23.Which of the following is correct?

-Refer to Figure 6-23.Which of the following is correct?

A) The entire burden of the tax falls on sellers,and none of the burden of the tax falls on buyers.

B) One-third of the burden of the tax falls on buyers,and two-thirds of the burden of the tax falls on sellers.

C) One-half of the burden of the tax falls on buyers,and one-half of the burden of the tax falls on sellers.

D) Two-thirds of the burden of the tax falls on buyers,and one-third of the burden of the tax falls on sellers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The burden of a luxury tax falls

A) more on the rich than on the middle class.

B) more on the poor than on the rich.

C) more on the middle class than on the rich.

D) equally on the rich,the middle class,and the poor.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A key lesson from the payroll tax is that the

A) tax is a tax solely on workers.

B) tax is a tax solely on firms that hire workers.

C) tax eliminates any wedge that might exist between the wage that firms pay and the wage that workers receive.

D) true burden of a tax cannot be legislated.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on sellers will shift the

A) demand curve upward by the amount of the tax.

B) demand curve downward by the amount of the tax.

C) supply curve upward by the amount of the tax.

D) supply curve downward by the amount of the tax.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Congress intended that

A) the entire FICA tax be paid by workers.

B) the entire FICA tax be paid by firms.

C) one-quarter of the FICA tax be paid by workers,and three-quarters be paid by firms.

D) half the FICA tax be paid by workers,and half be paid by firms.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-18

The vertical distance between points A and B represents the tax in the market.  -Refer to Figure 6-18.The amount of the tax per unit is

-Refer to Figure 6-18.The amount of the tax per unit is

A) $6.

B) $8.

C) $14.

D) $18.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The mayor of Workerville proposes a local payroll tax to fund a new water park for the city.The mayor proposes to collect half the tax from workers and half the tax from firms.The mayor will be able to successfully divide the burden of the tax equally if the

A) demand for labor is more elastic than the supply of labor.

B) supply of labor is more elastic than the demand for labor.

C) demand for labor and supply of labor are equally elastic.

D) It is not possible for the tax burden to fall equally on firms and workers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax incidence

A) is the manner in which the burden of a tax is shared among participants in a market.

B) can be shifted to the buyer by imposing the tax on the buyers of a product in a market.

C) can be shifted to the seller by imposing the tax on the sellers of a product in a market.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 199

Related Exams