B) False

Correct Answer

verified

Correct Answer

verified

True/False

A basic rule in capital budgeting is that if a project's NPV exceeds its IRR, then the project should be accepted.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) A project's regular IRR is found by discounting the cash inflows at the WACC to find the present value (PV) , then compounding this PV to find the IRR.

B) If a project's IRR is greater than the WACC, then its NPV must be negative.

C) To find a project's IRR, we must solve for the discount rate that causes the PV of the inflows to equal the PV of the project's costs.

D) To find a project's IRR, we must find a discount rate that is equal to the WACC.

E) A project's regular IRR is found by compounding the cash inflows at the WACC to find the terminal value (TV) , then discounting this TV at the WACC.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in the firm's WACC will decrease projects' NPVs, which could change the accept/reject decision for any potential project.However, such a change would have no impact on projects' IRRs.Therefore, the accept/reject decision under the IRR method is independent of the cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) To find the MIRR, we first compound cash flows at the regular IRR to find the TV, and then we discount the TV at the WACC to find the PV.

B) The NPV and IRR methods both assume that cash flows can be reinvested at the WACC.However, the MIRR method assumes reinvestment at the MIRR itself.

C) If two projects have the same cost, and if their NPV profiles cross in the upper right quadrant, then the project with the higher IRR probably has more of its cash flows coming in the later years.

D) If two projects have the same cost, and if their NPV profiles cross in the upper right quadrant, then the project with the lower IRR probably has more of its cash flows coming in the later years.

E) For a project with normal cash flows, any change in the WACC will change both the NPV and the IRR.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

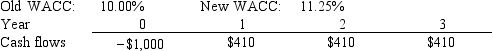

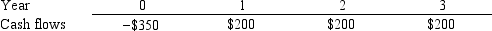

Last month, Standard Systems analyzed the project whose cash flows are shown below.However, before the decision to accept or reject the project took place, the Federal Reserve changed interest rates and therefore the firm's WACC.The Fed's action did not affect the forecasted cash flows.By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's expected NPV can be negative, in which case it should be rejected.

A) -$18.89

B) -$19.88

C) -$20.93

D) -$22.03

E) -$23.13

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One defect of the IRR method is that it does not take account of the time value of money.

B) One defect of the IRR method is that it does not take account of the cost of capital.

C) One defect of the IRR method is that it values a dollar received today the same as a dollar that will not be received until sometime in the future.

D) One defect of the IRR method is that it assumes that the cash flows to be received from a project can be reinvested at the IRR itself, and that assumption is often not valid.

E) One defect of the IRR method is that it does not take account of cash flows over a project's full life.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

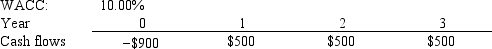

Craig's Car Wash Inc.is considering a project that has the following cash flow and WACC data.What is the project's discounted payback?

A) 1.88 years

B) 2.09 years

C) 2.29 years

D) 2.52 years

E) 2.78 years

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

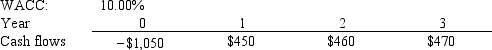

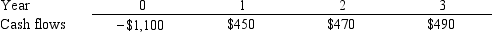

Reed Enterprises is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that a project's expected NPV can be negative, in which case it will be rejected.

A) $92.37

B) $96.99

C) $101.84

D) $106.93

E) $112.28

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider two projects, X and Y.Project X's IRR is 19% and Project Y's IRR is 17%.The projects have the same risk and the same lives, and each has constant cash flows during each year of their lives.If the WACC is 10%, Project Y has a higher NPV than X.Given this information, which of the following statements is CORRECT?

A) The crossover rate must be greater than 10%.

B) If the WACC is 8%, Project X will have the higher NPV.

C) If the WACC is 18%, Project Y will have the higher NPV.

D) Project X is larger in the sense that it has the higher initial cost.

E) The crossover rate must be less than 10%.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

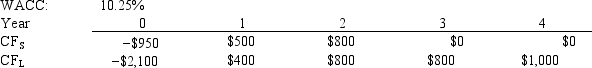

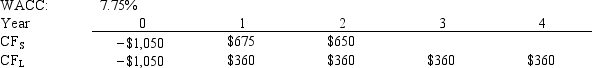

Farmer Co.is considering Projects S and L, whose cash flows are shown below.These projects are mutually exclusive, equally risky, and not repeatable.If the decision is made by choosing the project with the shorter payback, some value may be forgone.How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost.

A) $24.14

B) $26.82

C) $29.80

D) $33.11

E) $36.42

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Assuming that their NPVs based on the firm's cost of capital are equal, the NPV of a project whose cash flows accrue relatively rapidly will be more sensitive to changes in the discount rate than the NPV of a project whose cash flows come in later in its life.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Garner Inc.is considering a project that has the following cash flow data.What is the project's payback?

A) 1.42 years

B) 1.58 years

C) 1.75 years

D) 1.93 years

E) 2.12 years

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Both the regular and the modified IRR (MIRR)methods have wide appeal to professors, but most business executives prefer the NPV method to either of the IRR methods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) A project's regular IRR is found by compounding the cash inflows at the WACC to find the present value (PV) , then discounting the TV to find the IRR.

B) If a project's IRR is smaller than the WACC, then its NPV will be positive.

C) A project's IRR is the discount rate that causes the PV of the inflows to equal the project's cost.

D) If a project's IRR is positive, then its NPV must also be positive.

E) A project's regular IRR is found by compounding the initial cost at the WACC to find the terminal value (TV) , then discounting the TV at the WACC.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carolina Company is considering Projects S and L, whose cash flows are shown below.These projects are mutually exclusive, equally risky, and are not repeatable.If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under some conditions choosing projects on the basis of the IRR will cause $0.00 value to be lost.

A) $11.45

B) $12.72

C) $14.63

D) $16.82

E) $19.35

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kiley Electronics is considering a project that has the following cash flow data.What is the project's IRR? Note that a project's IRR can be less than the WACC (and even negative) , in which case it will be rejected.

A) 9.70%

B) 10.78%

C) 11.98%

D) 13.31%

E) 14.64%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When considering two mutually exclusive projects, the firm should always select the project whose internal rate of return is the highest, provided the projects have the same initial cost.This statement is true regardless of whether the projects can be repeated or not.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

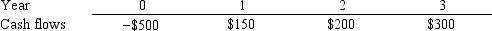

Worthington Inc.is considering a project that has the following cash flow data.What is the project's payback?

A) 2.03 years

B) 2.25 years

C) 2.50 years

D) 2.75 years

E) 3.03 years

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

No conflict will exist between the NPV and IRR methods, when used to evaluate two equally risky but mutually exclusive projects, if the projects' cost of capital exceeds the rate at which the projects' NPV profiles cross.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 108

Related Exams