A) The discounted payback method recognizes all cash flows over a project's life, and it also adjusts these cash flows to account for the time value of money.

B) The regular payback method was, years ago, widely used, but virtually no companies even calculate the payback today.

C) The regular payback is useful as an indicator of a project's liquidity because it gives managers an idea of how long it will take to recover the funds invested in a project.

D) The regular payback does not consider cash flows beyond the payback year, but the discounted payback overcomes this defect.

E) The regular payback method recognizes all cash flows over a project's life.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Projects S and L are both normal projects with an initial cost of $10, 000, followed by a series of positive cash inflows.Project S's undiscounted net cash flows total $20, 000, while L's total undiscounted flows are $30, 000.At a WACC of 10%, the two projects have identical NPVs.Which project's NPV is more sensitive to changes in the WACC?

A) Project L.

B) Both projects are equally sensitive to changes in the WACC since their NPVs are equal at all costs of capital.

C) Neither project is sensitive to changes in the discount rate, since both have NPV profiles that are horizontal.

D) The solution cannot be determined because the problem gives us no information that can be used to determine the projects' relative IRRs.

E) Project S.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If the cost of capital declines, this lowers a project's NPV.

B) The NPV method is regarded by most academics as being the best indicator of a project's profitability; hence, most academics recommend that firms use only this one method.

C) A project's NPV depends on the total amount of cash flows the project produces, but because the cash flows are discounted at the WACC, it does not matter if the cash flows occur early or late in the project's life.

D) The NPV and IRR methods may give different recommendations regarding which of two mutually exclusive projects should be accepted, but they always give the same recommendation regarding the acceptability of a normal, independent project.

E) The NPV method was once the favorite of academics and business executives, but today most authorities regard the MIRR as being the best indicator of a project's profitability.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider projects S and L.Both have normal cash flows, and the projects have the same risk, hence both are evaluated with the same WACC, 10%.However, S has a higher IRR than L.Which of the following statements is CORRECT?

A) If Project S has a positive NPV, Project L must also have a positive NPV.

B) If the WACC falls, each project's IRR will increase.

C) If the WACC increases, each project's IRR will decrease.

D) If Projects S and L have the same NPV at the current WACC, 10%, then Project L, the one with the lower IRR, would have a higher NPV if the WACC used to evaluate the projects declined.

E) Project S must have a higher NPV than Project L.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

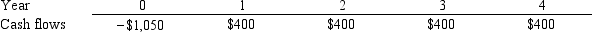

Spence Company is considering a project that has the following cash flow data.What is the project's IRR? Note that a project's IRR can be less than the WACC or negative, in both cases it will be rejected.

A) 14.05%

B) 15.61%

C) 17.34%

D) 19.27%

E) 21.20%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One drawback of the regular payback is that this method does not take account of cash flows beyond the payback period.

B) If a project's payback is positive, then the project should be accepted because it must have a positive NPV.

C) The regular payback ignores cash flows beyond the payback period, but the discounted payback method overcomes this problem.

D) One drawback of the discounted payback is that this method does not consider the time value of money, while the regular payback overcomes this drawback.

E) The shorter a project's payback period, the less desirable the project is normally considered to be by this criterion.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Martin Manufacturing is considering two normal, equally risky, mutually exclusive, but not repeatable projects.Martin's WACC is 10%.The two projects have the same investment costs, but Project A has an IRR of 15%, while Project B has an IRR of 20%.Assuming the projects' NPV profiles cross in the upper right quadrant, which of the following statements is CORRECT?

A) Since the projects are mutually exclusive, the firm should always select Project B.

B) If the crossover rate is 8%, Project B will have the higher NPV.

C) Only one project has a positive NPV.

D) If the crossover rate is 8%, Project A will have the higher NPV.

E) Each project must have a negative NPV.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The discounted payback method eliminates all of the problems associated with the payback method.

B) When evaluating independent projects, the NPV and IRR methods often yield conflicting results regarding a project's acceptability.

C) To find the MIRR, we discount the TV at the IRR.

D) A project's NPV profile must intersect the X-axis at the project's WACC.

E) The IRR method appeals to some managers because it gives an estimate of the rate of return on projects rather than a dollar amount, which the NPV method provides.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The payback method is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

B) The discounted payback method is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

C) The net present value method (NPV) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

D) The modified internal rate of return method (MIRR) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

E) The internal rate of return method (IRR) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) One drawback of the regular payback for evaluating projects is that this method does not properly account for the time value of money.

B) If a project's payback is positive, then the project should be rejected because it must have a negative NPV.

C) The regular payback ignores cash flows beyond the payback period, but the discounted payback method overcomes this problem.

D) If a company uses the same payback requirement to evaluate all projects, say it requires a payback of 4 years or less, then the company will tend to reject projects with relatively short lives and accept long-lived projects, and this will cause its risk to increase over time.

E) The longer a project's payback period, the more desirable the project is normally considered to be by this criterion.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Projects with "normal" cash flows can have two or more real IRRs.

B) Projects with "normal" cash flows must have two changes in the sign of the cash flows, e.g., from negative to positive to negative.If there are more than two sign changes, then the cash flow stream is "nonnormal."

C) The "multiple IRR problem" can arise if a project's cash flows are "normal."

D) Projects with "nonnormal" cash flows are almost never encountered in the real world.

E) Projects with "normal" cash flows can have only one real IRR.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

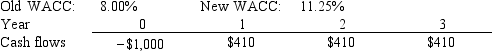

Corner Jewelers, Inc.recently analyzed the project whose cash flows are shown below.However, before the company decided to accept or reject the project, the Federal Reserve changed interest rates and therefore the firm's WACC.The Fed's action did not affect the forecasted cash flows.By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's expected NPV can be negative, in which case it should be rejected.

A) -$59.03

B) -$56.08

C) -$53.27

D) -$50.61

E) -$48.08

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The IRR of normal Project X is greater than the IRR of normal Project Y, and both IRRs are greater than zero.Also, the NPV of X is greater than the NPV of Y at the cost of capital.If the two projects are mutually exclusive, Project X should definitely be selected, and the investment made, provided we have confidence in the data.Put another way, it is impossible to draw NPV profiles that would suggest not accepting Project X.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The WACC for two mutually exclusive projects that are being considered is 12%.Project K has an IRR of 20% while Project R's IRR is 15%.The projects have the same NPV at the 12% current WACC.Interest rates are currently high.However, you believe that money costs and thus your WACC will soon decline.You also think that the projects will not be funded until the WACC has decreased, and their cash flows will not be affected by the change in economic conditions.Under these conditions, which of the following statements is CORRECT?

A) You should delay a decision until you have more information on the projects, even if this means that a competitor might come in and capture this market.

B) You should recommend Project R, because at the new WACC it will have the higher NPV.

C) You should recommend Project K, because at the new WACC it will have the higher NPV.

D) You should recommend Project R because it will have both a higher IRR and a higher NPV under the new conditions.

E) You should reject both projects because they will both have negative NPVs under the new conditions.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Project S has a pattern of high cash flows in its early life, while Project L has a longer life, with large cash flows late in its life.Neither has negative cash flows after Year 0, and at the current cost of capital, the two projects have identical NPVs.Now suppose interest rates and money costs decline.Other things held constant, this change will cause L to become preferred to S.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The NPV method's assumption that cash inflows are reinvested at the cost of capital is generally more reasonable than the IRR's assumption that cash flows are reinvested at the IRR.This is an important reason why the NPV method is generally preferred over the IRR method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Projects A and B are mutually exclusive and have normal cash flows.Project A has an IRR of 15% and B's IRR is 20%.The company's WACC is 12%, and at that rate Project A has the higher NPV.Which of the following statements is CORRECT?

A) Assuming the timing pattern of the two projects' cash flows is the same, Project B probably has a higher cost (and larger scale) .

B) Assuming the two projects have the same scale, Project B probably has a faster payback than Project A.

C) The crossover rate for the two projects must be 12%.

D) Since B has the higher IRR, then it must also have the higher NPV if the crossover rate is less than the WACC of 12%.

E) The crossover rate for the two projects must be less than 12%.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

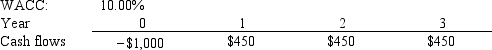

Multiple Choice

Computer Consultants Inc.is considering a project that has the following cash flow and WACC data.What is the project's MIRR? Note that a project's MIRR can be less than the WACC (and even negative) , in which case it will be rejected.

A) 9.32%

B) 10.35%

C) 11.50%

D) 12.78%

E) 14.20%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The NPV and IRR methods, when used to evaluate two independent and equally risky projects, will lead to different accept/reject decisions and thus capital budgets if the projects' IRRs are greater than their cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a firm relies exclusively on the payback method when making capital budgeting decisions, and it sets a 4-year payback regardless of economic conditions.Other things held constant, which of the following statements is most likely to be true?

A) It will accept too many long-term projects and reject too many short-term projects (as judged by the NPV) .

B) The firm will accept too many projects in all economic states because a 4-year payback is too low.

C) The firm will accept too few projects in all economic states because a 4-year payback is too high.

D) If the 4-year payback results in accepting just the right set of projects under average economic conditions, then this payback will result in too few long-term projects when the economy is weak.

E) It will accept too many short-term projects and reject too many long-term projects (as judged by the NPV) .

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 108

Related Exams