A) $41.58

B) $42.64

C) $43.71

D) $44.80

E) $45.92

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A share of Lash Inc.'s common stock just paid a dividend of $1.00.If the expected long-run growth rate for this stock is 5.4%, and if investors' required rate of return is 11.4%, what is the stock price?

A) $16.28

B) $16.70

C) $17.13

D) $17.57

E) $18.01

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Franklin Corporation is expected to pay a dividend of $1.25 per share at the end of the year (D? = $1.25) .The stock sells for $32.50 per share, and its required rate of return is 10.5%.The dividend is expected to grow at some constant rate, g, forever.What is the equilibrium expected growth rate?

A) 6.01%

B) 6.17%

C) 6.33%

D) 6.49%

E) 6.65%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kinkead Inc.forecasts that its free cash flow in the coming year, i.e., at t = 1, will be -$10 million, but its FCF at t = 2 will be $20 million.After Year 2, FCF is expected to grow at a constant rate of 4% forever.If the weighted average cost of capital is 14%, what is the firm's value of operations, in millions?

A) $158

B) $167

C) $175

D) $184

E) $193

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

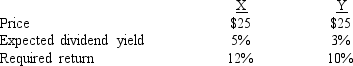

Stocks X and Y have the following data.Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT?

A) Stock X pays a higher dividend per share than Stock Y.

B) One year from now, Stock X should have the higher price.

C) Stock Y has a lower expected growth rate than Stock X.

D) Stock Y has the higher expected capital gains yield.

E) Stock Y pays a higher dividend per share than Stock X.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A and B have the same price and are in equilibrium, but Stock A has the higher required rate of return.Which of the following statements is CORRECT?

A) Stock B must have a higher dividend yield than Stock A.

B) Stock A must have a higher dividend yield than Stock B.

C) If Stock A has a higher dividend yield than Stock B, its expected capital gains yield must be lower than Stock B's.

D) Stock A must have both a higher dividend yield and a higher capital gains yield than Stock B.

E) If Stock A has a lower dividend yield than Stock B, its expected capital gains yield must be higher than Stock B's.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reynolds Construction's value of operations is $750 million based on the corporate valuation model.Its balance sheet shows $50 million of short-term investments that are unrelated to operations, $100 million of accounts payable, $100 million of notes payable, $200 million of long-term debt, $40 million of common stock (par plus paid-in-capital) , and $160 million of retained earnings.What is the best estimate for the firm's value of equity, in millions?

A) $429

B) $451

C) $475

D) $500

E) $525

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The cash flows associated with common stock are more difficult to estimate than those related to bonds because stock has a residual claim against the company versus a contractual obligation for a bond.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a stock's dividend is expected to grow at a constant rate of 5% a year, which of the following statements is CORRECT? The stock is in equilibrium.

A) The stock's dividend yield is 5%.

B) The price of the stock is expected to decline in the future.

C) The stock's required return must be equal to or less than 5%.

D) The stock's price one year from now is expected to be 5% above the current price.

E) The expected return on the stock is 5% a year.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Merrell Enterprises' stock has an expected return of 14%.The stock's dividend is expected to grow at a constant rate of 8%, and it currently sells for $50 a share.Which of the following statements is CORRECT?

A) The stock's dividend yield is 8%.

B) The current dividend per share is $4.00.

C) The stock price is expected to be $54 a share one year from now.

D) The stock price is expected to be $57 a share one year from now.

E) The stock's dividend yield is 7%.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If D? = $1.25, g (which is constant) = 5.5%, and P? = $44, what is the stock's expected total return for the coming year?

A) 7.54%

B) 7.73%

C) 7.93%

D) 8.13%

E) 8.34%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gere Furniture forecasts a free cash flow of $40 million in Year 3, i.e., at t = 3, and it expects FCF to grow at a constant rate of 5% thereafter.If the weighted average cost of capital is 10% and the cost of equity is 15%, what is the horizon value, in millions at t = 3?

A) $840

B) $882

C) $926

D) $972

E) $1, 021

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

50 per share is the current price for Foster Farms' stock.The dividend is projected to increase at a constant rate of 5.50% per year.The required rate of return on the stock, rs, is 9.00%.What is the stock's expected price 3 years from today?

A) $37.86

B) $38.83

C) $39.83

D) $40.85

E) $41.69

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Young & Liu Inc.'s free cash flow during the just-ended year (t = 0) was $100 million, and FCF is expected to grow at a constant rate of 5% in the future.If the weighted average cost of capital is 15%, what is the firm's value of operations, in millions?

A) $948

B) $998

C) $1, 050

D) $1, 103

E) $1, 158

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barnette Inc.'s free cash flows are expected to be unstable during the next few years while the company undergoes restructuring.However, FCF is expected to be $50 million in Year 5, i.e., FCF at t = 5 equals $50 million, and the FCF growth rate is expected to be constant at 6% beyond that point.If the weighted average cost of capital is 12%, what is the horizon value (in millions) at t = 5?

A) $719

B) $757

C) $797

D) $839

E) $883

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The value of Broadway-Brooks Inc.'s operations is $900 million, based on the corporate valuation model.Its balance sheet shows $70 million in accounts receivable, $50 million in inventory, $30 million in short-term investments that are unrelated to operations, $20 million in accounts payable, $110 million in notes payable, $90 million in long-term debt, $20 million in preferred stock, $140 million in retained earnings, and $280 million in total common equity.If the company has 25 million shares of stock outstanding, what is the best estimate of the stock's price per share?

A) $23.00

B) $25.56

C) $28.40

D) $31.24

E) $34.36

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The required returns of Stocks X and Y are rX = 10% and rY = 12%.Which of the following statements is CORRECT?

A) If Stock Y and Stock X have the same dividend yield, then Stock Y must have a lower expected capital gains yield than Stock X.

B) If Stock X and Stock Y have the same current dividend and the same expected dividend growth rate, then Stock Y must sell for a higher price.

C) The stocks must sell for the same price.

D) Stock Y must have a higher dividend yield than Stock X.

E) If the market is in equilibrium, and if Stock Y has the lower expected dividend yield, then it must have the higher expected growth rate.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alcott's preferred stock pays a dividend of $1.00 per quarter.If the price of the stock is $45.00, what is its nominal (not effective) annual rate of return?

A) 8.03%

B) 8.24%

C) 8.45%

D) 8.67%

E) 8.89%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock is expected to pay a dividend of $0.75 at the end of the year.The required rate of return is rs = 10.5%, and the expected constant growth rate is g = 6.4%.What is the stock's current price?

A) $17.39

B) $17.84

C) $18.29

D) $18.75

E) $19.22

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Projected free cash flows should be discounted at the firm's weighted average cost of capital to find the value of its operations.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 80

Related Exams