A) The proportion of interest versus principal repayment would be the same for each of the 7 payments.

B) The annual payments would be larger if the interest rate were lower.

C) If the loan were amortized over 10 years rather than 6 years, and if the interest rate were the same in either case, the first payment would include more dollars of interest under the 6-year amortization plan.

D) The proportion of each payment that represents interest as opposed to repayment of principal would be higher if the interest rate were lower.

E) The proportion of each payment that represents interest versus repayment of principal would be higher if the interest rate were higher.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose Sally Smith plans to invest $1, 000.She can earn an effective annual rate of 5% on Security A, while Security B has an effective annual rate of 12%.After 11 years, the compounded value of Security B should be more than twice the compounded value of Security A.(Ignore risk, and assume that compounding occurs annually.)

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

S.Treasury bond will pay a lump sum of $1, 000 exactly 3 years from today.The nominal interest rate is 6%, semiannual compounding.Which of the following statements is CORRECT?

A) The PV of the $1, 000 lump sum has a higher present value than the PV of a 3-year, $333.33 ordinary annuity.

B) The periodic interest rate is greater than 3%.

C) The periodic rate is less than 3%.

D) The present value would be greater if the lump sum were discounted back for more periods.

E) The present value of the $1, 000 would be smaller if interest were compounded monthly rather than semiannually.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

American Express and other credit card issuers must by law print the Annual Percentage Rate (APR) on their monthly statements.If the APR is stated to be 18.00%, with interest paid monthly, what is the card's EFF%?

A) 18.58%

B) 19.56%

C) 20.54%

D) 21.57%

E) 22.65%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Midway through the life of an amortized loan, the percentage of the payment that represents interest could be equal to, less than, or greater than to the percentage that represents repayment of principal.The proportions depend on the original life of the loan and the interest rate.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Which of the following bank accounts has the lowest effective annual return?

A) An account that pays 8% nominal interest with daily (365-day) compounding.

B) An account that pays 8% nominal interest with monthly compounding.

C) An account that pays 8% nominal interest with annual compounding.

D) An account that pays 7% nominal interest with daily (365-day) compounding.

E) An account that pays 7% nominal interest with monthly compounding.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If CF0 is positive and all the other CFs are negative, then you can still solve for I.

B) If you have a series of cash flows, each of which is positive, you can solve for I, where the solution value of I causes the PV of the cash flows to equal the cash flow at Time 0.

C) If you have a series of cash flows, and CF0 is negative but each of the following CFs is positive, you can solve for I, but only if the sum of the undiscounted cash flows exceeds the cost.

D) To solve for I, one must identify the value of I that causes the PV of the positive CFs to equal the absolute value of the FV of the negative CFs.It is impossible to find the value of I without a computer or financial calculator.

E) If you solve for I and get a negative number, then you must have made a mistake.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you borrowed $15, 000 at a rate of 8.5% and must repay it in 5 equal installments at the end of each of the next 5 years.By how much would you reduce the amount you owe in the first year?

A) $2, 404.91

B) $2, 531.49

C) $2, 658.06

D) $2, 790.96

E) $2, 930.51

G) B) and E)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

You borrowed $50, 000 which you must repay in 10 years.You plan to make an initial deposit today, then make 9 more deposits at the beginning of each the next 9 years, but with the deposits increasing at the inflation rate.You expect to earn 5% on your funds, and you expect a 3% inflation rate.To the nearest dollar, how large must your initial deposit be to enable you to reach your $50, 000 target?

A) $3, 008

B) $3, 342

C) $3, 676

D) $4, 044

E) $4, 448

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are hoping to buy a new boat 3 years from now, and you plan to save $4, 200 per year, beginning one year from today.You will deposit your savings in an account that pays 5.2% interest.How much will you have just after you make the 3rd deposit, 3 years from now?

A) $11, 973

B) $12, 603

C) $13, 267

D) $13, 930

E) $14, 626

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If some cash flows occur at the beginning of the periods while others occur at the ends, then we have what the textbook defines as a variable annuity.

B) The cash flows for an ordinary (or deferred) annuity all occur at the beginning of the periods.

C) If a series of unequal cash flows occurs at regular intervals, such as once a year, then the series is by definition an annuity.

D) The cash flows for an annuity due must all occur at the beginning of the periods.

E) The cash flows for an annuity may vary from period to period, but they must occur at regular intervals, such as once a year or once a month.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose Randy Jones plans to invest $1, 000.He can earn an effective annual rate of 5% on Security A, while Security B has an effective annual rate of 12%.After 11 years, the compounded value of Security B should be somewhat less than twice the compounded value of Security A.(Ignore risk, and assume that compounding occurs annually.)

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After receiving a reward for information leading to the arrest of a notorious criminal, you are considering investing it in an annuity that pays $5, 000 at the end of each year for 20 years.You could earn 5% on your money in other investments with equal risk.What is the most you should pay for the annuity?

A) $50, 753

B) $53, 424

C) $56, 236

D) $59, 195

E) $62, 311

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

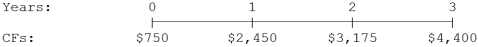

What is the present value of the following cash flow stream at a rate of 8.0%?

A) $7, 917

B) $8, 333

C) $8, 772

D) $9, 233

E) $9, 695

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Time lines cannot be constructed where some of the payments constitute an annuity but others are unequal and thus are not part of the annuity.

B) A time line is not meaningful unless all cash flows occur annually.

C) Time lines are not useful for visualizing complex problems prior to doing actual calculations.

D) Time lines can be constructed to deal with situations where some of the cash flows occur annually but others occur quarterly.

E) Time lines can only be constructed for annuities where the payments occur at the end of the periods, i.e., for ordinary annuities.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your Aunt Elsa has $500, 000 invested at 6.5%, and she plans to retire.She wants to withdraw $40, 000 at the beginning of each year, starting immediately.What is the maximum number of whole payments that can be withdrawn before the account is exhausted, i.e., before the account balance would become negative? (Hint: Round down to the nearest whole number.)

A) 18

B) 19

C) 20

D) 21

E) 22

G) B) and E)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

Cyberhost Corporation's sales were $225 million last year.If sales grow at 6% per year, how large (in millions) will they be 5 years later?

A) $271.74

B) $286.05

C) $301.10

D) $316.16

E) $331.96

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You expect to receive $5, 000 in 25 years.How much is it worth today if the discount rate is 5.5%?

A) $1, 067.95

B) $1, 124.16

C) $1, 183.33

D) $1, 245.61

E) $1, 311.17

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Some of the cash flows shown on a time line can be in the form of annuity payments, but none can be uneven amounts.

B) A time line is not meaningful unless all cash flows occur annually.

C) Time lines are not useful for visualizing complex problems prior to doing actual calculations.

D) Time lines cannot be constructed in situations where some of the cash flows occur annually but others occur quarterly.

E) Time lines can be constructed for annuities where the payments occur at either the beginning or the end of the periods.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following investments, which would have the lowest present value? Assume that the effective annual rate for all investments is the same and is greater than zero.

A) Investment A pays $250 at the end of every year for the next 10 years (a total of 10 payments) .

B) Investment B pays $125 at the end of every 6-month period for the next 10 years (a total of 20 payments) .

C) Investment C pays $125 at the beginning of every 6-month period for the next 10 years (a total of 20 payments) .

D) Investment D pays $2, 500 at the end of 10 years (just one payment) .

E) Investment E pays $250 at the beginning of every year for the next 10 years (a total of 10 payments) .

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 168

Related Exams