A) Uncollectible Accounts Receivable

B) Accounts Receivable

C) Allowance for Doubtful Accounts

D) Bad Debts Expense

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $460,000 and Allowance for Doubtful Accounts has a balance of $30,000. What is the net realizable value of the accounts receivable?

A) $30,000

B) $430,000

C) $460,000

D) $490,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the allowance method of accounting for uncollectible receivables, writing off an uncollectible account.

A) affects only income statement accounts.

B) is not an acceptable practice.

C) affects only balance sheet accounts.

D) affects both balance sheet and income statement accounts.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two methods of accounting for uncollectible accounts are the

A) direct write-off method and the allowance method.

B) allowance method and the accrual method.

C) allowance method and the net realizable method.

D) direct write-off method and the accrual method.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The party promising to pay a note at maturity is the maker.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

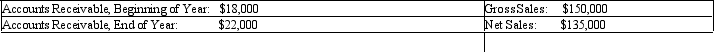

Given the following information, compute Accounts Receivable Turnover:

A) 6.75

B) 7.5

C) 6.13

D) 6.82

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An aging of a company's accounts receivable indicates the estimate of uncollectible receivables totals $2,000. If Allowance for Doubtful Accounts has a $200 credit balance, the adjustment to record the bad debt expense for the period will require a

A) debit to Bad Debt Expense for $2,200.

B) debit to Bad Debt Expense for $2,000.

C) debit to Bad Debt Expense for $1,800.

D) credit to Allowance for Doubtful Accounts for $3,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 141 - 147 of 147

Related Exams