A) Interest Expense 9,600 Cash 110,400

Notes Payable 120,000

B) Cash 120,000 Notes Payable 120,000

C) Cash 129,600 Interest Expense 9,600

Notes Payable 120,000

D) Notes Payable 120,000 Interest Payable 7,200

Cash 120,000

Interest Expense 7,200

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an internal control procedure for payroll?

A) observe clocking in and out time for the employees

B) payroll depends on a fired employee's supervisor to notify them when an employee has been fired

C) payroll requires employees to show identification when picking up their paychecks

D) changes in pay rates on a computerized system must be tested by someone independent of payroll

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

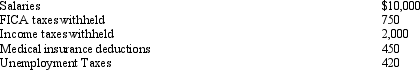

The following totals for the month of April were taken from the payroll register of Magnum Company.

The entry to record accrual of employer's payroll taxes would include a

The entry to record accrual of employer's payroll taxes would include a

A) debit to Payroll Tax Expense for $1,170

B) debit to FICA Taxes Payable for $1,500

C) credit to Payroll Tax Expense for $420

D) debit to Payroll Tax Expense for $1,620

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Like many taxes deducted from employee earnings,federal income taxes are subject to a maximum amount per employee per year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

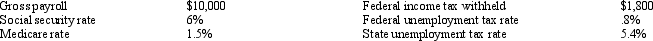

Use the following information to answer the following questions.

Assuming no employees are subject to ceilings for their earnings,Jensen Company has the following information for the pay period of January 15 - 31,20xx.

Assuming that all wages are subject to federal and state unemployment taxes,the Payroll Taxes Expense would be recorded as:

Assuming that all wages are subject to federal and state unemployment taxes,the Payroll Taxes Expense would be recorded as:

A) $1,370

B) $750

C) $620

D) $2,870

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are included in the employer's payroll taxes?

A) SUTA taxes

B) FUTA taxes

C) FICA taxes

D) all of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total earnings of an employee for a payroll period is referred to as

A) take-home pay

B) pay net of taxes

C) net pay

D) gross pay

F) C) and D)

Correct Answer

verified

D

Correct Answer

verified

True/False

One of the more popular defined contribution plans is the 401k plan.

B) False

Correct Answer

verified

True

Correct Answer

verified

Essay

Mobile Sales has five sales employees which receive weekly paychecks.Each earns $11.50 per hour and each has worked 40 hours in the pay period.Each employee pays 12% of gross in Federal Income Tax,3% in State Income Tax,6% of gross in Social Security Tax,1.5% of gross in Medicare Tax,and 1/2% in State Disability Insurance.Journalize the recognition the pay period ending January 19th which will be paid to the employees January 26th.(Keep in mind that none of the employees is subject to a ceiling amount for social security. )

Correct Answer

verified

Correct Answer

verified

True/False

Internal controls for cash payments also apply to payrolls.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Prior to the last weekly payroll period of the calendar year,the cumulative earnings of employees A and B are $99,350 and $91,000 respectively.Their earnings for the last completed payroll period of the year are $850 each.The maximum amount of earnings subject to social security tax at 6% is $100,000.All earnings are subject to Medicare tax of 1.5%.Assuming that the payroll will be paid on December 29,what will be the employer's total FICA tax for this payroll period on the two salary amounts of $850 each?

A) $127.50

B) $115.50

C) $112.50

D) $0

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During May,Blast sold 650 portable CD players for $50 each.Each CD player cost Blast $25 to purchase and carried a one-year warranty.If 10 percent of the goods sold typically need to be replaced over the warranty period,what amount should Blast debit Product Warranty Expense for in May?

A) $3,250

B) $1,625

C) $ 650

D) $1,300

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the most desirable quick ratio?

A) 1.20

B) 1.00

C) 0.95

D) 0.50

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year,proceeds of $48,750 were received from discounting a $50,000,90-day note at a bank.The discount rate used by the bank in computing the proceeds was

A) 6.25%

B) 10.00%

C) 10.26%

D) 9.75%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of a product warranty should be included as an expense in the

A) period the cash is collected for a product sold on account

B) future period when the cost of repairing the product is paid

C) period of the sale of the product

D) future period when the product is repaired or replaced

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Taxes deducted from an employee's earnings to finance social security and Medicare benefits are called FICA taxes.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

Payroll taxes levied against employers become an employer liability at the time the employee wages are incurred.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would most likely be classified as a current liability?

A) Two-year Notes Payable

B) Bonds Payable

C) Mortgage Payable

D) Unearned Rent

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Another name for the quick ratio is

A) quick cash ratio

B) current ratio

C) working capital ratio

D) acid-test ratio

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

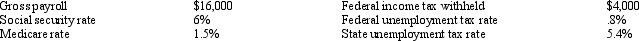

Assuming no employees are subject to ceilings for their earnings,Moore Company has the following information for the pay period of December 15 - 31,20xx.

Salaries Payable would be recorded for

Salaries Payable would be recorded for

A) $16,000

B) $ 9,808

C) $10,800

D) $11,040

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 171

Related Exams