A) hours worked

B) medicare tax rate

C) rate of pay

D) social security number

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zennia Company provides its employees with varying amount of vacation per year, depending on the length of employment. The estimated amount of the current year's vacation cost is $135,000. The journal entry to record the adjusting entry required on December 31, the end of the current year, to record the current month's accrued vacation pay is

A) $135,000

B) $67,500

C) $0

D) $11,250

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An employee receives an hourly rate of $15, with time and a half for all hours worked in excess of 40 during the week. Payroll data for the current week are as follows: hours worked, 48; federal income tax withheld, $120; cumulative earnings for the year prior to this week, $24,500; Social security tax rate, 6% on maximum of $100,000; and Medicare tax rate, 1.5% on all earnings; state unemployment compensation tax, 3.4% on the first $7,000; federal unemployment compensation tax, .8% on the first $7,000. What is the net amount to be paid to the employee?

A) $568.74

B) $601.50

C) $660.00

D) $574.90

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Excel Products Inc. pays its employees semimonthly. The summary of the payroll for December 31, 2012 indicated the following:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record partially funded pension rights for its salaried employees, at the end of the year is

A) debit Salary Expense; credit Cash

B) debit Pension Expense; credit Unfunded Pension Liability

C) debit Pension Expense; credit Unfunded Pension Liability and Cash

D) debit Pension Expense; credit Cash

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record the estimated accrued product warranty liability is

A) debit Product Warranty Expense; credit Product Warranty Payable

B) debit Product Warranty Payable; credit Cash

C) debit Product Warranty Expense; credit Cash

D) debit Product Warranty Payable; credit Product Warranty Expense

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Payroll taxes levied against employees become liabilities

A) the first of the following month

B) when salary is accrued

C) when data is entered in a payroll register

D) at the end of an accounting period

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The total net pay for a period is determined from the payroll register.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to a summary of the payroll of Scotland Company, $450,000 was subject to the 7.0% social security tax and $500,000 was subject to the 1.5% Medicare tax. Federal income tax withheld was $98,000. Also, $15,000 was subject to state (4.2%) and federal (0.8%) unemployment taxes. The journal entry to record accrued salaries would include:

A) a debit to Salary Payable of $450,000

B) a credit to Salary Payable of $500,000

C) a debit to Salary Expense of $500,000

D) a credit to Salary Expense of $450,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An unfunded pension liability is reported on the balance sheet as

A) current liability

B) owner's equity

C) long-term liability

D) current liability or long-term liability, depending upon when the pension liability is to be paid

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

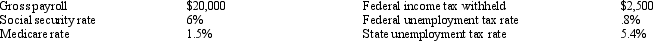

Darius Company has the following information for the pay period of January 15 - 31, 20xx.

Assuming no employees are subject to ceilings for their earnings, calculate Salaries Payable and Employer Payroll Taxes Payable.

Assuming no employees are subject to ceilings for their earnings, calculate Salaries Payable and Employer Payroll Taxes Payable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an internal control procedure for payroll?

A) observe clocking in and out time for the employees

B) payroll depends on a fired employee's supervisor to notify them when an employee has been fired

C) payroll requires employees to show identification when picking up their paychecks

D) changes in pay rates on a computerized system must be tested by someone independent of payroll

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

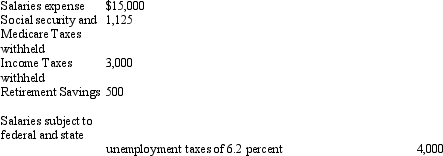

The following totals for the month of June were taken from the payroll register of Young Company:  The entry to record the accrual of employer's payroll taxes would include a

The entry to record the accrual of employer's payroll taxes would include a

A) debit to Payroll Taxes Expense for $2,498

B) debit to Social Security and Medicare Tax Payable for $2,250

C) debit to Payroll Taxes Expense for $1,373

D) Debit to Payroll Tax Expense for $1,125

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year, proceeds of $48,750 were received from discounting a $50,000, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was

A) 6.25%

B) 10.00%

C) 10.26%

D) 9.75%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 161 - 174 of 174

Related Exams