A) 1.08

B) .93

C) 6.57

D) 7.07

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balanced scorecard measures financial and nonfinancial performance of a business. The balanced scorecard measures four areas. Identify one of the following that is not included as a performance measurement.

A) Internal Process

B) Financial

C) Innovation and Learning

D) Employees

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a disadvantage of decentralization?

A) Decisions made by one manager may negatively affect the profitability of the entire company.

B) Helps retain quality managers.

C) Decision making by managers closest to the operations.

D) Managers are able to acquire expertise in their areas of responsibility.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Purchase requisitions for Purchasing and the number of payroll checks for Payroll Accounting are examples of activity bases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For higher levels of management, responsibility accounting reports:

A) are more detailed than for lower levels of management

B) are more summarized than for lower levels of management

C) contain about the same level of detail as reports for lower levels of management

D) are rarely provided or reviewed

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mason Corporation had $650,000 in invested assets, sales of $700,000, income from operations amounting to $99,000, and a desired minimum rate of return of 15%. The residual income for Mason is:

A) $0

B) $84,150

C) ($6,000)

D) $1,500

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the term used to describe expenses that are incurred for the benefit of a specific department?

A) Indirect expenses

B) Margin expenses

C) Departmental expenses

D) Direct expenses

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Budget performance reports prepared for the vice-president of production would generally contain less detail than reports prepared for the various plant managers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

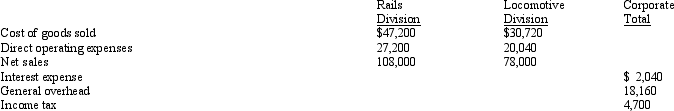

The following financial information was summarized from the accounting records of Train Corporation for the current year ended December 31:  The income from operations for the Locomotive Division is:

The income from operations for the Locomotive Division is:

A) $57,960

B) $14,790

C) $27,240

D) $47,280

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Income from operations of the Commercial Aviation Division is $2,225,000. If income from operations before service department charges is $3,250,000:

A) operating expenses are $1,025,000

B) total service department charges are $1,025,000

C) noncontrollable charges are $1,025,000

D) direct manufacturing charges are $1,025,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

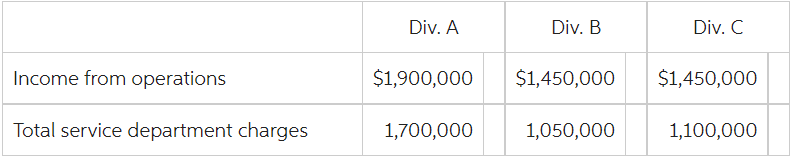

The following data are taken from the management accounting reports of Dulcimer Co.:  If an incentive bonus is paid to the manager who achieved the highest income from operations before service department charges, it follows that:

If an incentive bonus is paid to the manager who achieved the highest income from operations before service department charges, it follows that:

A) Division A's manager is given the bonus

B) Division B's manager is given the bonus

C) Division C's manager is given the bonus

D) The managers of Divisions B and C divide the bonus

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most manufacturing plants are considered cost centers because they have control over

A) sales and costs.

B) fixed assets and costs.

C) costs only.

D) fixed assets and sales.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are advantages of decentralization except:

A) Managers make better decisions when closer to the operation of the company.

B) Expertise in all areas of the business is difficult, decentralization makes it better to delegate certain responsibilities.

C) Each decentralized operation purchases their own assets and pays for operating costs.

D) Decentralized managers can respond quickly to customer satisfaction and quality service.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Clydesdale Company has sales of $4,500,000. It also has invested assets of $2,000,000 and operating expenses of $3,600,000. The company has established a minimum rate of return of 7%. What is Clydesdale Company's rate of return on investment?

A) 56%

B) 20%

C) 45%

D) 25%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following expressions is termed the profit margin factor as used in determining the rate of return on investment?

A) Sales/Income From Operations

B) Income From Operations/Sales

C) Invested Assets/Sales

D) Sales/Invested Assets

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hamlin Corporation had $220,000 in invested assets, sales of $242,000, income from operations amounting to $70,400, and a desired minimum rate of return of 3%. The rate of return on investment for Hamlin is:

A) 7%

B) 32%

C) 3%

D) 29%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Income from operations for Division Z is $250,000, total service department charges are $400,000 and operating expenses are $2,266,000. What are the revenues for Division Z?

A) $650,000

B) $2,516,000

C) $2,916,000

D) $2,666,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

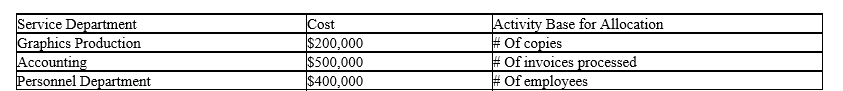

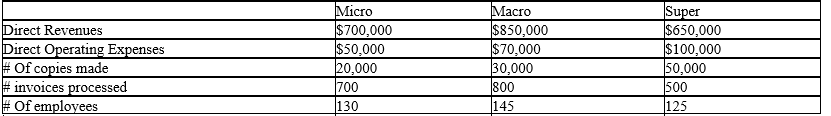

ABC Corporation has three service departments with the following costs and activity base:  ABC has three operating divisions, Micro, Macro and Super. Their revenue, cost and activity information are as follows:

ABC has three operating divisions, Micro, Macro and Super. Their revenue, cost and activity information are as follows:

How much service department cost would be allocated to the Super Division?

How much service department cost would be allocated to the Super Division?

A) $350,000

B) $100,000

C) $125,000

D) $550,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

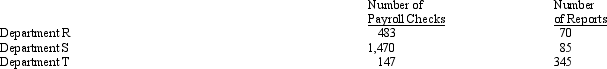

A department store apportions payroll costs on the basis of the number of payroll checks issued. Accounting costs are apportioned on the basis of the number of reports. The payroll costs for the year were $231,000 and the accounting costs for the year totaled $75,500. The departments and the number of payroll checks and accounting reports for each are as follows:

Determine the amount of (a) payroll cost and (b) accounting cost to be apportioned to each department.

Determine the amount of (a) payroll cost and (b) accounting cost to be apportioned to each department.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Materials used by Jefferson Company in producing Division C's product are currently purchased from outside suppliers at a cost of $10 per unit. However, the same materials are available from Division A. Division A has unused capacity and can produce the materials needed by Division C at a variable cost of $8.50 per unit. A transfer price of $9.50 per unit is negotiated and 25,000 units of material are transferred, with no reduction in Division A's current sales. How much would Division A's income from operations increase?

A) $0

B) $75,000

C) $25,000

D) $50,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 198

Related Exams