A) required to be reported on the balance sheet

B) required to be reported on the income statement

C) required to be reported on the statement of cash flows

D) not required to be reported on any statement

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firefly Inc.sold land for $225,000 cash.The land had been purchased five years earlier for $275,000.The loss on the sale was reported on the income statement.On the statement of cash flows,what amount should Firefly report as an investing activity from the sale of the land?

A) $225,000

B) $275,000

C) $50,000

D) $500,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

For each of the following,identify whether it would be disclosed as an operating (O),financing (F),or investing (I)activity on the statement of cash flows under the indirect method. a.Gain from sale of land b.Paid dividends c.Purchased equipment d.Net income e.Issued company's common stockf. Amortization expense

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Land costing $140,000 was sold for $173,000 cash.The gain on the sale was reported on the income statement as other income.On the statement of cash flows,what amount should be reported as an investing activity from the sale of land?

A) $173,000

B) $140,000

C) $313,000

D) $33,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from investing activities,as part of the statement of cash flows,would include any payments for the purchase of treasury stock.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

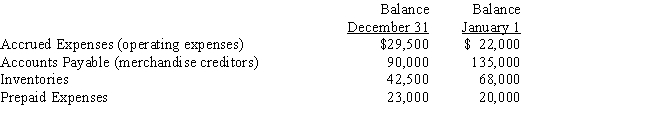

Selected data for the current year ended December 31 are as follows:  During the current year,the cost of merchandise sold was $620,000 and the operating expenses other than depreciation were $142,000.The direct method is used for presenting the cash flows from operating activities on the statement of cash flows.Determine the amount reported on the statement of cash flows for

(a)cash payments for merchandise and

(b)cash payments for operating expenses.

During the current year,the cost of merchandise sold was $620,000 and the operating expenses other than depreciation were $142,000.The direct method is used for presenting the cash flows from operating activities on the statement of cash flows.Determine the amount reported on the statement of cash flows for

(a)cash payments for merchandise and

(b)cash payments for operating expenses.

Correct Answer

verified

Correct Answer

verified

Essay

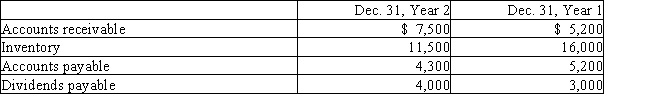

Fortune Corporation's comparative balance sheet for current assets and liabilities was as follows:  Adjust Year 2 net income of $65,000 for changes in operating assets and liabilities to arrive at cash flows from operating activities using the indirect method.

Adjust Year 2 net income of $65,000 for changes in operating assets and liabilities to arrive at cash flows from operating activities using the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be on the statement of cash flows?

A) cash flows from investing activities

B) cash flows from financing activities

C) cash flows from operating activities

D) cash flows from contingent activities

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information below for Washington Company to answer the following questions.

The following selected account balances appeared on the financial statements of Washington Company:

Washington Company uses the direct method to calculate net cash flow from operating activities.

-Cash payments for merchandise were

Washington Company uses the direct method to calculate net cash flow from operating activities.

-Cash payments for merchandise were

A) $39,000

B) $33,000

C) $29,000

D) $23,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

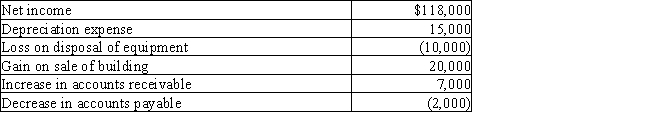

Kennedy,Inc.reported the following data:  Prepare the Cash flows from operating activities section of the statement of cash flows using the indirect method.

Prepare the Cash flows from operating activities section of the statement of cash flows using the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchases equipment for $32,000 cash.This transaction should be shown on the statement of cash flows under

A) investing activities

B) financing activities

C) noncash investing and financing activities

D) operating activities

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash dividends paid on capital stock would be reported in the statement of cash flows in

A) the Cash flows from financing activities section

B) the Cash flows from investing activities section

C) a separate schedule

D) the Cash flows from operating activities section

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Free cash flow is

A) all cash in the bank

B) cash from operations

C) cash from financing less cash used to purchase fixed assets to maintain productive capacity and cash used for dividends

D) cash flow from operations less cash used to purchase fixed assets to maintain productive capacity

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows,the Cash flows from financing activities section would include all of the following except

A) receipts from the sale of bonds payable

B) payments for dividends

C) payments for purchase of treasury stock

D) payments of interest on bonds payable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the section of the statement of cash flows (a-d) where each of the following items would be reported. -Sale of machinery held for use by the company

A) Operating activities

B) Financing activities

C) Investing activities

D) Schedule of noncash financing and investing

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the section of the statement of cash flows (a-d) where each of the following items would be reported. -Increase in accounts receivable

A) Operating activities

B) Financing activities

C) Investing activities

D) Schedule of noncash financing and investing

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The acquisition of land in exchange for common stock is an example of a noncash investing and financing activity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

To determine cash payments for operating expenses for the statement of cash flows using the direct method,a decrease in prepaid expenses is added to operating expenses other than depreciation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the section of the statement of cash flows (a-d) where each of the following items would be reported. -Issuance of bond payable

A) Operating activities

B) Financing activities

C) Investing activities

D) Schedule of noncash financing and investing

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows,the Cash flows from financing activities section would include

A) receipts from the sale of investments

B) payments for the acquisition of investments

C) receipts from a note receivable

D) receipts from the issuance of capital stock

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 187

Related Exams