B) False

Correct Answer

verified

Correct Answer

verified

True/False

If factory overhead applied exceeds the actual costs,overhead is said to be overapplied.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

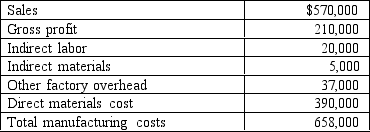

The following information is available for the first month of operations for Brandt,Inc.:

-Calculate direct labor cost for Brandt,Inc.

-Calculate direct labor cost for Brandt,Inc.

A) $226,000

B) $206,000

C) $231,000

D) $218,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of a manufactured product generally consists of which of the following costs?

A) Direct materials cost and factory overhead cost

B) Direct labor cost and factory overhead cost

C) Direct labor cost,direct materials cost,and factory overhead cost

D) Direct materials cost and direct labor cost

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pull manufacturing is driven by which of the following?

A) Customer demand

B) Forecasting customers' requirements

C) A production schedule rather than line status

D) Pushing inventory ahead to the next station

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An activity-based costing system allocates factory overhead rates to products or Services using

A) a single plantwide rate.

B) the cost of activities based on an activity rate times the number of activity-based usage quantities.

C) an allocation of budgeted revenues produced by a product or service .

D) an end-of-year allocation of costs to products or services.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bell Manufacturers Inc.has estimated total factory overhead costs of $60,000 and 10,000 direct labor hours for the current fiscal year.If job number 117 incurred 2,000 direct labor hours,the work in process account will be increased and factory overhead will be Decreased for

A) $10,000.

B) $0.

C) $12,000.

D) $2,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Increases in the Work in Process account occur when

A) materials are received into the storeroom.

B) factory overhead costs are incurred.

C) direct labor is recorded from the time sheets.

D) All of these increase work in process.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A summary of the materials requisitions completed during a period serves as the basis for transferring the cost of the materials from the materials account to

A) work in process and cost of goods sold.

B) work in process and factory overhead.

C) finished goods and cost of goods sold.

D) work in process and finished goods.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following manufacturing costs is an indirect cost of producing a product?

A) Oil lubricants used for factory machinery

B) Commissions for sales personnel

C) Hourly wages of an assembly worker

D) Memory chips for a microcomputer manufacturer

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A difference in quantity of materials used on two comparable jobs may be caused by

A) inadequately trained employees.

B) poor quality materials.

C) employee carelessness.

D) all of these.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Materials inventory contains the costs of direct and indirect materials that have NOT yet entered the manufacturing process.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of materials entering directly into the manufacturing process is classified as

A) direct labor cost.

B) factory overhead cost.

C) burden cost.

D) direct materials cost.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In a job order cost accounting system for a service business,materials costs are normally included as part of overhead.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The underapplied factory overhead amount may be transferred to Cost of Goods Sold at the end of the fiscal year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The finished goods account is the controlling account for the

A) sales ledger.

B) materials ledger.

C) work in process ledger.

D) stock ledger.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cambridge Corporation applied factory overhead costs of $205,000 to production during the current year.At the end of the year,total overapplied factory overhead is $17,000.What was the amount of actual factory overhead cost incurred during the year?

A) $222,000

B) $200,000

C) $205,000

D) $188,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hudson,Inc.has estimated total factory overhead costs of $400,000 and 20,000 direct labor hours for the current fiscal year.If direct labor hours for Job N41 total 1,500,calculate applied factory overhead applied to this job.

A) $40,000

B) $20,000

C) $3,000

D) $30,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

As product costs are incurred in the manufacturing process,they are accounted for as assets and reported on the balance sheet as inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would most likely be a period cost?

A) Depreciation on factory lunchroom furniture

B) Salary of telephone receptionist in the sales office

C) Salary of a security guard for the factory parking lot

D) Computer chips used by a computer manufacturer

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 116

Related Exams