B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With the aid of computer software,managers can vary assumptions regarding selling prices,costs,and volume and can immediately see the effects of each change on the break-even point and profit.Such an analysis is called

A) "what if" or sensitivity analysis.

B) vary the data analysis.

C) computer-aided analysis.

D) data gathering.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a business sells four products,it is NOT possible to estimate the break-even point.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If sales are $820,000,variable costs are 68% of sales,and operating income is $260,000,what is the contribution margin ratio?

A) 53%

B) 38%

C) 47%

D) 32%

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

True/False

Variable costs are costs that vary in total in direct proportion to changes in the activity level.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Even if a business sells six products,it is possible to estimate the break-even point.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If fixed costs are $450,000 and the unit contribution margin is $50,the sales necessary to earn an operating income of $30,000 are 14,000 units.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A production supervisor's salary that does NOT vary with the number of units produced is an example of a fixed cost.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Direct materials and direct labor costs are examples of variable costs of production.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

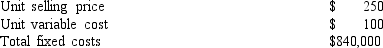

Foggy Co.has the following operating data for its manufacturing operations:

The company has decided to increase the wages of hourly workers,which will increase the unit variable cost by 10%.Increases in the salaries of factory supervisors and property taxes for the factory will increase fixed costs by 4%.If sales prices are held constant,the break-even point for Flynn Co.will

The company has decided to increase the wages of hourly workers,which will increase the unit variable cost by 10%.Increases in the salaries of factory supervisors and property taxes for the factory will increase fixed costs by 4%.If sales prices are held constant,the break-even point for Flynn Co.will

A) increase by 400 units.

B) increase by 640 units.

C) decrease by 640 units.

D) increase by 800 units.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The data required for determining the break-even point for a business are the total estimated fixed costs for a period stated as a percentage of net sales.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If sales are $200,000,variable costs are 56% of sales,and operating income is $30,000,what is the contribution margin ratio?

A) 42%

B) 37%

C) 44%

D) 15%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

For purposes of analysis,mixed costs can generally be separated into their variable and fixed components.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

Variable costs are costs that vary on a per-unit basis as the level of manufacturing activity changes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the volume of sales is $6,000,000 and sales at the break-even point amount to $4,800,000,the margin of safety is 20%.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If yearly insurance premiums are increased,this change in fixed costs will result in a decrease in the break-even point.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

For the coming year,Belton Company estimates fixed costs at $60,000,the unit variable cost at $25,and the unit selling price at $50.Determine (a)the break-even point in units of sales, (b)the unit sales required to realize operating income of $100,000,and (c)the probable operating income if sales total $400,000.

Correct Answer

verified

Correct Answer

verified

True/False

Total fixed costs remain constant as the level of activity changes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between the current sales revenue and the sales at the break-even point is called the

A) contribution margin.

B) margin of safety.

C) price factor.

D) operating leverage.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A low operating leverage is normal for highly automated industries.

B) False

Correct Answer

verified

False

Correct Answer

verified

Showing 1 - 20 of 139

Related Exams