B) False

Correct Answer

verified

Correct Answer

verified

True/False

When evaluating a proposal by use of the net present value method,if there is an excess of present value over the amount to be invested,the rate of return on the proposal is more than the rate used in the analysis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A series of unequal cash flows at fixed intervals is termed an annuity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The anticipated purchase of a fixed asset for $400,000,with a useful life of 5 years and no residual value,is expected to yield total net income of $200,000 for the 5 years.The expected average rate of return on investment is 20%.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Decisions to install new equipment,replace old equipment,and purchase or construct a new building are examples of

A) sales mix analysis.

B) variable cost analysis.

C) Variable cost analysis.

D) capital investment analysis.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average rate of return for this investment is

A) 5%.

B) 10%.

C) 25%.

D) 15%.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

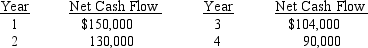

A $350,000 capital investment proposal has an estimated life of four years and no residual value.The estimated net cash flows are as follows:

The minimum desired rate of return for net present value analysis is 12%.The present value of $1 at compound interest of 12% for 1,2,3,and 4 years is .893,.797,.712,and .636,respectively.Determine the net present value.

The minimum desired rate of return for net present value analysis is 12%.The present value of $1 at compound interest of 12% for 1,2,3,and 4 years is .893,.797,.712,and .636,respectively.Determine the net present value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

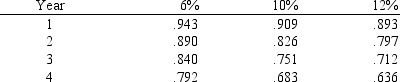

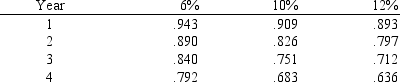

The rate of earnings is 10% and the cash to be received in two years is $10,000.Determine the present value amount,using the following partial table of present value of $1 at compound interest.

A) $8,900

B) $8,260

C) $7,970

D) $9,090

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The average rate of return method of capital investment analysis gives consideration to the present value of future cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a present value method of analyzing capital investment proposals?

A) Average rate of return

B) Cash payback method

C) Accounting rate of return

D) Net present value

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

By converting dollars to be received in the future into current dollars,the present value methods take into consideration that money

A) has an international rate of exchange.

B) is the language of business.

C) is the measure of assets,liabilities,and stockholders' equity on financial statements.

D) has a time value.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the following partial table of present value of $1 at compound interest,determine the present value of $20,000 to be received three years hence,with earnings at the rate of 10%

A year.

A) $14,240

B) $16,800

C) $15,020

D) $15,840

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net present value for this investment is

A) positive $24,960.

B) negative $27,600.

C) positive $27,600.

D) negative $24,960.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

Harris Co.is considering a 12-year project that is estimated to cost $900,000 and has no residual value.Harris seeks to earn an average rate of return of 15% on all capital projects.Determine the necessary average annual income (using straight-line depreciation)that must be achieved on this project for it to be acceptable to Harris Co.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following can be used to place capital investment proposals involving different amounts of investment on a comparable basis for purposes of net present value analysis?

A) Price-level index

B) Present value factor

C) Annuity

D) Present value index

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which method of evaluating capital investment proposals uses present value concepts to compute the rate of return from the net cash flows expected from capital investment proposals?

A) Internal rate of return

B) Cash payback

C) Net present value

D) Average rate of return

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Qualitative considerations in capital investment decisions are most appropriate for strategic investments or those that are designed to affect a company's long-term ability to generate profits.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The expected period of time that will elapse between the date of a capital investment and the complete recovery in cash of the amount invested is called the cash payback period.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

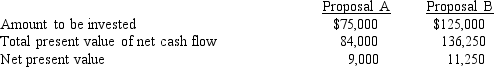

The net present value has been computed for Proposals A and B.Relevant data are as follows:

Determine the present value index for each proposal.

Determine the present value index for each proposal.

Correct Answer

verified

Correct Answer

verified

True/False

The anticipated purchase of a fixed asset for $400,000,with a useful life of 5 years and a $40,000 residual value,is expected to yield total net income of $200,000 for the 5 years.The expected average rate of return on investment is 18.2%.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 103

Related Exams