A) Based on the information we are given, and assuming those are the views of the marginal investor, it is apparent that the two stocks are in equilibrium.

B) Portfolio P has more market risk than Stock A but less market risk than B.

C) Stock A should have a higher expected return than Stock B as viewed by the marginal investor.

D) Portfolio P has a coefficient of variation equal to 2.5.

E) Portfolio P has a standard deviation of 25% and a beta of 1.0.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta = 0.8, while Stock B has a beta = 1.6. Which of the following statements is CORRECT?

A) If the marginal investor becomes more risk averse, the required return on Stock B will increase by more than the required return on Stock A.

B) An equally weighted portfolio of Stocks A and B will have a beta lower than 1.2.

C) If the marginal investor becomes more risk averse, the required return on Stock A will increase by more than the required return on Stock B.

D) If the risk-free rate increases but the market risk premium remains constant, the required return on Stock A will increase by more than that on Stock B.

E) Stock B's required return is double that of Stock A's.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

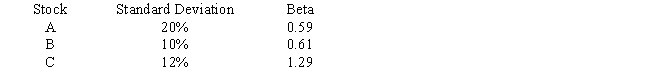

You are considering investing in one of the these three stocks: If you are a strict risk minimizer, you would choose Stock ____ if it is to be held in isolation and Stock ____ if it is to be held as part of a well-diversified portfolio.

A) A; B.

B) B; A.

C) C; A.

D) C; B.

E) A; A.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Since the market return represents the expected return on an average stock, the market return reflects a certain amount of risk. As a result, there exists a market risk premium, which is the amount over and above the risk-free rate, that is required to compensate stock investors for assuming an average amount of risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is most likely to occur as you add randomly selected stocks to your portfolio, which currently consists of 3 average stocks?

A) The expected return of your portfolio is likely to decline.

B) The diversifiable risk will remain the same, but the market risk will likely decline.

C) Both the diversifiable risk and the market risk of your portfolio are likely to decline.

D) The total risk of your portfolio should decline, and as a result, the expected rate of return on the portfolio should also decline.

E) The diversifiable risk of your portfolio will likely decline, but the expected market risk should not change.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 0.7, whereas Stock B has a beta of 1.3. Portfolio P has 50% invested in both A and B. Which of the following would occur if the market risk premium increased by 1% but the risk-free rate remained constant?

A) The required return on both stocks would increase by 1%.

B) The required return on Portfolio P would remain unchanged.

C) The required return on Stock A would increase by more than 1%, while the return on Stock B would increase by less than 1%.

D) The required return for Stock A would fall, but the required return for Stock B would increase.

E) The required return on Portfolio P would increase by 1%.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 0.8 and Stock B has a beta of 1.2. 50% of Portfolio P is invested in Stock A and 50% is invested in Stock B. If the market risk premium (rM − rRF) were to increase but the risk-free rate (rRF) remained constant, which of the following would occur?

A) The required return would decrease by the same amount for both Stock A and Stock B.

B) The required return would increase for Stock A but decrease for Stock B.

C) The required return on Portfolio P would remain unchanged.

D) The required return would increase for Stock B but decrease for Stock A.

E) The required return would increase for both stocks but the increase would be greater for Stock B than for Stock A.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

When adding a randomly chosen new stock to an existing portfolio, the higher (or more positive) the degree of correlation between the new stock and stocks already in the portfolio, the less the additional stock will reduce the portfolio's risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiske Roofing Supplies' stock has a beta of 1.23, its required return is 11.75%, and the risk-free rate is 4.30%. What is the required rate of return on the market? (Hint: First find the market risk premium.)

A) 10.36%

B) 10.62%

C) 10.88%

D) 11.15%

E) 11.43%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The realized return on a stock portfolio is the weighted average of the expected returns on the stocks in the portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Portfolio A has but one security, while Portfolio B has 100 securities. Because of diversification effects, we would expect Portfolio B to have the lower risk. However, it is possible for Portfolio A to be less risky.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The slope of the Security Market Line is beta.

B) Any stock with a negative beta must in theory have a negative required rate of return, provided rRF is positive.

C) If a stock's beta doubles, its required rate of return must also double.

D) If a stock's returns are negatively correlated with returns on most other stocks, the stock's beta will be negative.

E) If a stock has a beta of to 1.0, its required rate of return will be unaffected by changes in the market risk premium.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Under the CAPM, the required rate of return on a firm's common stock is determined only by the firm's market risk. If its market risk is known, and if that risk is expected to remain constant, then analysts have all the information they need to calculate the firm's required rate of return.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

It is possible for a firm to have a positive beta, even if the correlation between its returns and those of another firm is negative.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The SML shows the relationship between companies' required returns and their diversifiable risks. The slope and intercept of this line cannot be influenced by a firm's managers, but the position of the company on the line can be influenced by its managers.

B) Suppose you plotted the returns of a given stock against those of the market, and you found that the slope of the regression line was negative. The CAPM would indicate that the required rate of return on the stock should be less than the risk-free rate for a well-diversified investor, assuming investors expect the observed relationship to continue on into the future.

C) If investors become less risk averse, the slope of the Security Market Line will increase.

D) If a company increases its use of debt, this is likely to cause the slope of its SML to increase, indicating a higher required return on the stock.

E) The slope of the SML is determined by the value of beta.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Stan holds a portfolio consisting of a $10,000 investment in each of 8 different common stocks. The portfolio's beta is 1.25. Now suppose Stan decided to sell one of his stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.35. What would the portfolio's new beta be?

A) 1.17

B) 1.23

C) 1.29

D) 1.36

E) 1.43

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following information and then calculate the required rate of return for the Universal Investment Fund, which holds 4 stocks. The market's required rate of return is 13.25%, the risk-free rate is 7.00%, and the Fund's assets are as follows:

A) 9.58%

B) 10.09%

C) 10.62%

D) 11.18%

E) 11.77%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If investors become less averse to risk, the slope of the Security Market Line (SML) will increase.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two stocks in your portfolio, X and Y, have independent returns, so the correlation between them, rXY is zero. Your portfolio consists of $50,000 invested in Stock X and $50,000 invested in Stock Y. Both stocks have an expected return of 15%, betas of 1.6, and standard deviations of 30%. Which of the following statements best describes the characteristics of your 2-stock portfolio?

A) Your portfolio has a standard deviation less than 30%, and its beta is greater than 1.6.

B) Your portfolio has a beta equal to 1.6, and its expected return is 15%.

C) Your portfolio has a beta greater than 1.6, and its expected return is greater than 15%.

D) Your portfolio has a standard deviation greater than 30% and a beta equal to 1.6.

E) Your portfolio has a standard deviation of 30%, and its expected return is 15%.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the risk-free rate is 6% and the market risk premium is 5%. Given this information, which of the following statements is CORRECT?

A) If a stock has a negative beta, its required return must also be negative.

B) An index fund with beta = 1.0 should have a required return less than 11%.

C) If a stock's beta doubles, its required return must also double.

D) An index fund with beta = 1.0 should have a required return greater than 11%.

E) An index fund with beta = 1.0 should have a required return of 11%.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 146

Related Exams