B) False

Correct Answer

verified

Correct Answer

verified

True/False

If an investor buys enough stocks, he or she can, through diversification, eliminate all of the market risk inherent in owning stocks, but as a general rule it will not be possible to eliminate all diversifiable risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

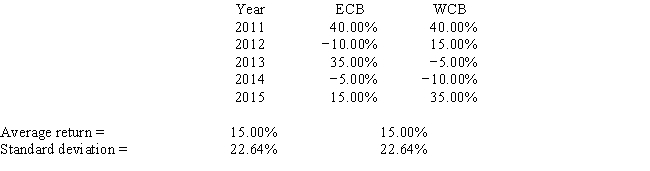

Assume that your cousin holds just one stock, Eastman Chemical Bonding (ECB) , which he thinks has very little risk. You agree that the stock is relatively safe, but you want to demonstrate that his risk would be even lower if he were more diversified. You obtain the following returns data for Wilder's Creations and Buildings (WCB) . Both companies have had less variability than most other stocks over the past 5 years. Measured by the standard deviation of returns, by how much would your cousin's risk have been reduced if he had held a portfolio consisting of 60% in ECB and the remainder in WCB? (Hint: Use the sample standard deviation formula.)

A) 3.29%

B) 3.46%

C) 3.65%

D) 3.84%

E) 4.03%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

One key conclusion of the Capital Asset Pricing Model is that the value of an asset should be measured by considering both the risk and the expected return of the asset, assuming that the asset is held in a well-diversified portfolio. The risk of the asset held in isolation is not relevant under the CAPM.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A and B are quite similar: Each has an expected return of 12%, a beta of 1.2, and a standard deviation of 25%. The returns on the two stocks have a correlation of 0.6. Portfolio P has 50% in Stock A and 50% in Stock B. Which of the following statements is CORRECT?

A) Portfolio P has a standard deviation that is greater than 25%.

B) Portfolio P has an expected return that is less than 12%.

C) Portfolio P has a standard deviation that is less than 25%.

D) Portfolio P has a beta that is less than 1.2.

E) Portfolio P has a beta that is greater than 1.2.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hazel Morrison, a mutual fund manager, has a $40 million portfolio with a beta of 1.00. The risk-free rate is 4.25%, and the market risk premium is 6.00%. Hazel expects to receive an additional $60 million, which she plans to invest in additional stocks. After investing the additional funds, she wants the fund's required and expected return to be 13.00%. What must the average beta of the new stocks be to achieve the target required rate of return?

A) 1.68

B) 1.76

C) 1.85

D) 1.94

E) 2.04

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Other things held constant, if investors suddenly become convinced that there will be deflation in the economy, then the required returns on all stocks should increase.

B) If a company's beta were cut in half, then its required rate of return would also be halved.

C) If the risk-free rate rises by 0.5% but the market risk premium declines by that same amount, then the required rates of return on stocks with betas less than 1.0 will decline while returns on stocks with betas above 1.0 will increase.

D) If the risk-free rate rises by 0.5% but the market risk premium declines by that same amount, then the required rate of return on an average stock will remain unchanged, but required returns on stocks with betas less than 1.0 will rise.

E) If a company's beta doubles, then its required rate of return will also double.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If investors are risk averse and hold only one stock, we can conclude that the required rate of return on a stock whose standard deviation is 0.21 will be greater than the required return on a stock whose standard deviation is 0.10. However, if stocks are held in portfolios, it is possible that the required return could be higher on the stock with the low standard deviation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Portfolio P has equal amounts invested in each of the three stocks, A, B, and C. Stock A has a beta of 0.8, Stock B has a beta of 1.0, and Stock C has a beta of 1.2. Each of the stocks has a standard deviation of 25%. The returns on the three stocks are independent of one another (i.e., the correlation coefficients all equal zero) . Assume that there is an increase in the market risk premium, but the risk-free rate remains unchanged. Which of the following statements is CORRECT?

A) The required return on Stock A will increase by less than the increase in the market risk premium, while the required return on Stock C will increase by more than the increase in the market risk premium.

B) The required return on the average stock will remain unchanged, but the returns of riskier stocks (such as Stock C) will increase while the returns of safer stocks (such as Stock A) will decrease.

C) The required returns on all three stocks will increase by the amount of the increase in the market risk premium.

D) The required return on the average stock will remain unchanged, but the returns on riskier stocks (such as Stock C) will decrease while the returns on safer stocks (such as Stock A) will increase.

E) The required return of all stocks will remain unchanged since there was no change in their betas.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The tighter the probability distribution of its expected future returns, the greater the risk of a given investment as measured by its standard deviation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Someone who is risk averse has a general dislike for risk and a preference for certainty. If risk aversion exists in the market, then investors in general are willing to accept somewhat lower returns on less risky securities. Different investors have different degrees of risk aversion, and the end result is that investors with greater risk aversion tend to hold securities with lower risk (and therefore a lower expected return) than investors who have more tolerance for risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The CAPM has been thoroughly tested, and the theory has been confirmed beyond any reasonable doubt.

B) If two "normal" or "typical" stocks were combined to form a 2-stock portfolio, the portfolio's expected return would be a weighted average of the stocks' expected returns, but the portfolio's standard deviation would probably be greater than the average of the stocks' standard deviations.

C) If investors become more risk averse, then (1) the slope of the SML would increase and (2) the required rate of return on low-beta stocks would increase by more than the required return on high-beta stocks.

D) An increase in expected inflation, combined with a constant real risk-free rate and a constant market risk premium, would lead to identical increases in the required returns on a riskless asset and on an average stock, other things held constant.

E) A graph of the SML as applied to individual stocks would show required rates of return on the vertical axis and standard deviations of returns on the horizontal axis.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Recession, inflation, and high interest rates are economic events that are best characterized as being

A) company-specific risk factors that can be diversified away.

B) among the factors that are responsible for market risk.

C) risks that are beyond the control of investors and thus should not be considered by security analysts or portfolio managers.

D) irrelevant except to governmental authorities like the Federal Reserve.

E) systematic risk factors that can be diversified away.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jenna holds a diversified $100,000 portfolio consisting of 20 stocks with $5,000 invested in each. The portfolio's beta is 1.12. Jenna plans to sell a stock with b = 0.90 and use the proceeds to buy a new stock with b = 1.80. What will the portfolio's new beta be?

A) 1.286

B) 1.255

C) 1.224

D) 1.194

E) 1.165

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A portfolio's risk is measured by the weighted average of the standard deviations of the securities in the portfolio. It is this aspect of portfolios that allows investors to combine stocks and thus reduce the riskiness of their portfolios.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a portfolio of three randomly selected stocks, which of the following could NOT be true; i.e., which statement is false?

A) The standard deviation of the portfolio is greater than the standard deviation of one or two of the stocks.

B) The beta of the portfolio is lower than the lowest of the three betas.

C) The beta of the portfolio is equal to one of the three stock's betas.

D) The beta of the portfolio is equal to 1.

E) The standard deviation of the portfolio is less than the standard deviation of each of the stocks if they were held in isolation.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock LB has a beta of 0.5 and Stock HB has a beta of 1.5. The market is in equilibrium, with required returns equaling expected returns. Which of the following statements is CORRECT?

A) If both expected inflation and the market risk premium (rM − rRF) increase, the required return on Stock HB will increase by more than that on Stock LB.

B) If both expected inflation and the market risk premium (rM − rRF) increase, the required returns of both stocks will increase by the same amount.

C) Since the market is in equilibrium, the required returns of the two stocks should be the same.

D) If expected inflation remains constant but the market risk premium (rM − rRF) declines, the required return of Stock HB will decline but the required return of Stock LB will increase.

E) If expected inflation remains constant but the market risk premium (rM − rRF) declines, the required return of Stock LB will decline but the required return of Stock HB will increase.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Federal Reserve actions have caused an increase in the risk-free rate, rRF. Meanwhile, investors are afraid of a recession, so the market risk premium, (rM − rRF) , has increased. Under these conditions, with other things held constant, which of the following statements is most correct?

A) The required return on all stocks would increase, but the increase would be greatest for stocks with betas of less than 1.0.

B) Stocks' required returns would change, but so would expected returns, and the result would be no change in stocks' prices.

C) The prices of all stocks would decline, but the decline would be greatest for high-beta stocks.

D) The prices of all stocks would increase, but the increase would be greatest for high-beta stocks.

E) The required return on all stocks would increase by the same amount.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A firm can change its beta through managerial decisions, including capital budgeting and capital structure decisions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A's stock has a beta of 1.30, and its required return is 12.00%. Stock B's beta is 0.80. If the risk-free rate is 4.75%, what is the required rate of return on B's stock? (Hint: First find the market risk premium.)

A) 8.76%

B) 8.98%

C) 9.21%

D) 9.44%

E) 9.68%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 146

Related Exams