A) Demand variability.

B) Sales price variability.

C) The extent to which operating costs are fixed.

D) Changes in required returns due to financing decisions.

E) The ability to change prices as costs change.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Business risk depends on all of the following factors except ____.

A) sales variability

B) interest rates

C) input price variability

D) change in output prices

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

As the percentage of debt in a firm's capital structure increases,its financial risk increases.Once the firm increases its debt beyond the optimal level,rising interest charges result in an immediate decrease in EPS.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A consistent supply of capital is essential for the long-run success of a firm.Although a firm may have access to capital under all types of economic conditions,the concept of financial flexibility implies that the firm can obtain capital on acceptable,competitive terms.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company has decided that its capital budget during the coming year will be $20 million.Its optimal capital structure is 60 percent equity and 40 percent debt.Its earnings before interest and taxes (EBIT) are projected to be $34.667 million for the year.The company has $200 million of assets;its average interest rate on outstanding debt is 10 percent;and its tax rate is 40 percent.If the company follows the residual dividend policy and maintains the same capital structure,what will its dividend payout ratio be?

A) 15%

B) 20%

C) 25%

D) 30%

E) 35%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) There have been no significant observed differences in the capital structures of U.S.corporations in comparison to their German and Japanese counterparts.

B) Different countries use essentially the same international accounting conventions with respect to reporting assets on a historical versus replacement cost basis.

C) An analysis of both bankruptcy and equity reporting costs leads to the conclusion that U.S.firms should have more equity and less debt than firms in Japan and Germany.

D) Equity monitoring costs are higher in the United States than in Japan and Germany.

E) Debt monitoring costs are probably lower in the United States than in Japan and Germany.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A firm that follows a residual dividend policy must believe that the dividend irrelevance theory is correct.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

One implication of information asymmetry between investors and firm managers is that if a firm raises new capital by issuing debt rather than by selling stock,it signals that the firm has very good prospects.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

____ information is the situation in which managers have better information about the firm's prospects.

A) Asymmetric

B) Symmetric

C) Perfect

D) Public

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a firm conducts a seasoned equity offering and uses the proceeds to purchase a portion of the firm's outstanding debt,then the firm's

A) financial risk increases.

B) financial risk decreases.

C) business risk increases.

D) business risk decreases.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

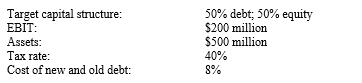

The following facts apply to your company:  Based on the residual dividend policy,the payout ratio is 60 percent.How large (in millions of dollars) will the capital budget be?

Based on the residual dividend policy,the payout ratio is 60 percent.How large (in millions of dollars) will the capital budget be?

A) $43.2

B) $50.0

C) $64.8

D) $86.4

E) $108.0

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Generally,the more stable a firm's operations,the more debt it can handle in its capital structure.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The ability of a firm to raise sufficient capital on competitive terms under adverse conditions in order to sustain steady operations is referred to as financial flexibility.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Modigliani and Miller's dividend irrelevance theory says that dividend policy does not affect a firm's value but can affect its cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The "Pure Modigliani and Miller Result" establishes,under restrictive assumptions,that the firm's stock price will be maximized if it uses virtually 100 percent debt.Which of the following real world conditions does the most to limit real world corporate debt-to-assets ratios to far less than 100 percent?

A) There are brokerage costs.

B) At high levels of debt revenues decline.

C) Investors can't really borrow at the same rate as corporations.

D) Interest rates increase as the debt-to-assets ratio rises.

E) Dividends are relevant in the real world.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a factor that influences capital structure decisions for firms?

A) financial flexibility

B) rational investors

C) business risk

D) tax position

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Underlying the dividend irrelevance theory proposed by Miller and Modigliani is their argument that the value of the firm is determined only by its basic earning power and its business risk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The optimal capital structure is that which results in the highest earnings per share because that will ensure maximum stock price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

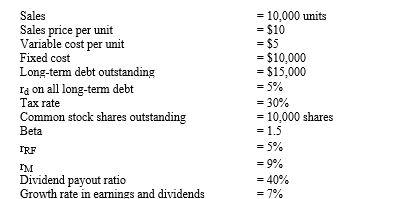

Calculate the current price per share (P0) for Olson Corporation,given the following information.The data all pertain to the year just ended.

A) $39.20

B) $57.84

C) $29.43

D) $61.90

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Once the target capital structure for a firm is decided,managerial decisions can result in the actual capital structure differing from the target structure,but operating conditions will have a negligible effect on actual capital structure.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 120

Related Exams