A) The discount rate increases.

B) The cash flows are in the form of a deferred annuity, and they total to $100,000. You learn that the annuity lasts for 10 years rather than 5 years, hence that each payment is for $10,000 rather than for $20,000.

C) The discount rate decreases.

D) The riskiness of the investment's cash flows increases.

E) The total amount of cash flows remains the same, but more of the cash flows are received in the later years and less are received in the earlier years.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following investments,which would have the lowest present value? Assume that the effective annual rate for all investments is the same and is greater than zero.

A) Investment A pays $250 at the end of every year for the next 10 years (a total of 10 payments) .

B) Investment B pays $125 at the end of every 6-month period for the next 10 years (a total of 20 payments) .

C) Investment C pays $125 at the beginning of every 6-month period for the next 10 years (a total of 20 payments) .

D) Investment D pays $2,500 at the end of 10 years (just one payment) .

E) Investment E pays $250 at the beginning of every year for the next 10 years (a total of 10 payments) .

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

American Express and other credit card issuers must by law print the Annual Percentage Rate (APR) on their monthly statements.If the APR is stated to be 18.00%,with interest paid monthly,what is the card's EFF%?

A) 18.58%

B) 19.56%

C) 20.54%

D) 21.57%

E) 22.65%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Time lines can be constructed for annuities where the payments occur at either the beginning or the end of the periods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your bank offers a 10-year certificate of deposit (CD) that pays 6.5% interest,compounded annually.If you invest $2,000 in the CD,how much will you have when it matures?

A) $3,754.27

B) $3,941.99

C) $4,139.09

D) $4,346.04

E) $4,563.34

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scott and Linda have been saving to pay for their daughter Casie's college education.Casie just turned 10 at (t = 0) ,and she will be entering college 8 years from now (at t = 8) .College tuition and expenses at State U.are currently $14,500 a year,but they are expected to increase at a rate of 3.5% a year.Ellen should graduate in 4 years-if she takes longer or wants to go to graduate school,she will be on her own.Tuition and other costs will be due at the beginning of each school year (at t = 8,9,10,and 11) . So far,Scott and Linda have accumulated $15,000 in their college savings account (at t = 0) .Their long-run financial plan is to add an additional $5,000 in each of the next 4 years (at t = 1,2,3,and 4) .Then they plan to make 3 equal annual contributions in each of the following years,t = 5,6,and 7.They expect their investment account to earn 9%.How large must the annual payments at t = 5,6,and 7 be to cover Casie's anticipated college costs?

A) $1,965.21

B) $2,068.64

C) $2,177.51

D) $2,292.12

E) $2,412.76

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Disregarding risk,if money has time value,it is impossible for the present value of a given sum to exceed its future value.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a bank compounds savings accounts quarterly,the effective annual rate will exceed the nominal rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your sister paid $10,000 (CF at t = 0) for an investment that promises to pay $750 at the end of each of the next 5 years,then an additional lump sum payment of $10,000 at the end of the 5th year.What is the expected rate of return on this investment?

A) 6.77%

B) 7.13%

C) 7.50%

D) 7.88%

E) 8.27%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An uncle of yours who is about to retire wants to sell some of his stock and buy an annuity that will provide him with income of $50,000 per year for 30 years,beginning a year from today.The going rate on such annuities is 7.25%.How much would it cost him to buy such an annuity today?

A) $574,924

B) $605,183

C) $635,442

D) $667,214

E) $700,575

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

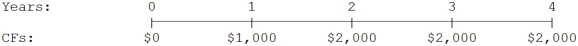

You sold your motorcycle and accepted a note with the following cash flow stream as your payment.What was the effective price you received for the car assuming an interest rate of 6.0%?

A) $5,987

B) $6,286

C) $6,600

D) $6,930

E) $7,277

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How much would $1,growing at 3.5% per year,be worth after 75 years?

A) $12.54

B) $13.20

C) $13.86

D) $14.55

E) $15.28

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you borrowed $14,000 at a rate of 10.0% and must repay it in 5 equal installments at the end of each of the next 5 years.How much interest would you have to pay in the first year?

A) $1,200.33

B) $1,263.50

C) $1,330.00

D) $1,400.00

E) $1,470.00

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You plan to invest some money in a bank account.Which of the following banks provides you with the highest effective rate of interest?

A) Bank 1; 6.1% with annual compounding.

B) Bank 2; 6.0% with monthly compounding.

C) Bank 3; 6.0% with annual compounding.

D) Bank 4; 6.0% with quarterly compounding.

E) Bank 5; 6.0% with daily (365-day) compounding.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If some cash flows occur at the beginning of the periods while others occur at the ends, then we have what the textbook defines as a variable annuity.

B) The cash flows for an ordinary (or deferred) annuity all occur at the beginning of the periods.

C) If a series of unequal cash flows occurs at regular intervals, such as once a year, then the series is by definition an annuity.

D) The cash flows for an annuity due must all occur at the beginning of the periods.

E) The cash flows for an annuity may vary from period to period, but they must occur at regular intervals, such as once a year or once a month.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you inherited $275,000 and invested it at 8.25% per year.How much could you withdraw at the beginning of each of the next 20 years?

A) $22,598.63

B) $23,788.03

C) $25,040.03

D) $26,357.92

E) $27,675.82

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are in negotiations to make a 7-year loan of $25,000 to DeVille Corporation.To repay you,DeVille will pay $2,500 at the end of Year 1,$5,000 at the end of Year 2,and $7,500 at the end of Year 3,plus a fixed but currently unspecified cash flow,X,at the end of each year from Year 4 through Year 7.You are confident the payments will be made,since DeVille is essentially riskless.You regard 8% as an appropriate rate of return on a low risk but illiquid 7-year loan.What cash flow must the investment provide at the end of each of the final 4 years,that is,what is X?

A) $4,271.67

B) $4,496.49

C) $4,733.15

D) $4,969.81

E) $5,218.30

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your bank offers to lend you $100,000 at an 8.5% annual interest rate to start your new business.The terms require you to amortize the loan with 10 equal end-of-year payments.How much interest would you be paying in Year 2?

A) $7,531

B) $7,927

C) $8,323

D) $8,740

E) $9,177

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You want to open a sushi bar 3 years from now,and you plan to save $7,000 per year,beginning immediately.You will make 3 deposits in an account that pays 5.2% interest.Under these assumptions,how much will you have 3 years from today?

A) $20,993

B) $22,098

C) $23,261

D) $24,424

E) $25,645

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT,assuming positive interest rates and holding other things constant?

A) Banks A and B offer the same nominal annual rate of interest, but A pays interest quarterly and B pays semiannually. Deposits in Bank B will provide the higher future value if you leave your funds on deposit.

B) The present value of a 5-year, $250 annuity due will be lower than the PV of a similar ordinary annuity.

C) A 30-year, $150,000 amortized mortgage will have larger monthly payments than an otherwise similar 20-year mortgage.

D) A bank loan's nominal interest rate will always be equal to or greater than its effective annual rate.

E) If an investment pays 10% interest, compounded quarterly, its effective annual rate will be greater than 10%.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 168

Related Exams