B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The collection of a $6,000 account within the 2 percent discount period will result in a

A) debit to Sales Discounts for $120.

B) debit to Accounts Receivable for $5,880.

C) credit to Cash for $5,880.

D) credit to Accounts Receivable for $5,880.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts is not closed to Income Summary?

A) Cost of Goods Sold

B) Inventory

C) Sales Revenue

D) Sales Discounts

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dawson's Fashions sold merchandise for $40,000 cash during the month of July.Returns that month totaled $1,000.If the company's gross profit rate is 40%, Dawson's will report monthly net sales revenue and cost of goods sold of

A) $39,000 and $23,400.

B) $39,000 and $24,000.

C) $40,000 and $23,400.

D) $40,000 and $24,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be considered a merchandising company?

A) Retailer

B) Wholesaler

C) Service firm

D) All of these are considered a merchandising company.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial information is presented below:  The gross profit rate would be

The gross profit rate would be

A) .36.

B) .40.

C) .46.

D) .50.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

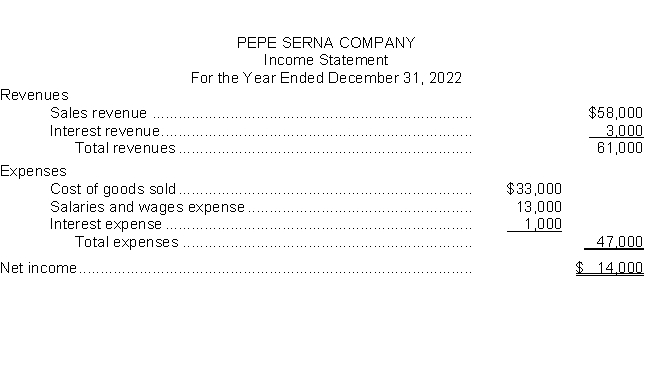

The income statement for Pepe Serna Company for the year ended December 31, 2022 is as follows:  Prepare the entries to close the revenue and expense accounts at December 31, 2022.You may omit explanations for the transactions.

Prepare the entries to close the revenue and expense accounts at December 31, 2022.You may omit explanations for the transactions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a purchaser using a perpetual system agrees to freight terms of FOB shipping point, then the

A) Inventory account will be increased.

B) Inventory account will not be affected.

C) seller will bear the freight cost.

D) carrier will bear the freight cost.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a perpetual inventory system, the amount of the discount allowed for paying for merchandise purchased within the discount period is credited to

A) Inventory.

B) Purchase Discounts.

C) Purchase Allowance.

D) Sales Discounts.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

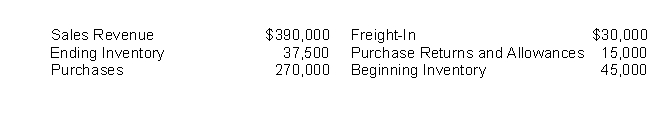

The following information is available for Dennehy Company:  Dennehy's cost of goods sold is

Dennehy's cost of goods sold is

A) $262,500.

B) $285,000.

C) $292,500.

D) $345,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under IFRS, companies must classify income statement items by

A) function.

B) nature.

C) nature or function

D) date incurred.

IFRS.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The use of IFRS results in the number of transactions affecting inventory to be

A) more than under GAAP.

B) the same as under GAAP.

C) less than under GAAP.

D) to be zero.

IFRS.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a true statement about inventory systems?

A) Periodic inventory systems require more detailed inventory records.

B) Perpetual inventory systems require more detailed inventory records.

C) A periodic system requires cost of goods sold be determined after each sale.

D) A perpetual system determines cost of goods sold only at the end of the accounting period.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The credit terms offered to a customer by a business firm are 2/10, n/30, which means that

A) the customer must pay the bill within 10 days.

B) the customer can deduct a 2% discount if the bill is paid between the 10th and 30th day from the invoice date.

C) the customer can deduct a 2% discount if the bill is paid within 10 days of the invoice date.

D) two sales returns can be made within 10 days of the invoice date and no returns thereafter.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The respective normal account balances of Sales Revenue, Sales Returns and Allowances, and Sales Discounts are

A) credit, credit, credit.

B) debit, credit, debit.

C) credit, debit, debit.

D) credit, debit, credit.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The terms 2/10, n/30 state that a 2% discount is available if the invoice is paid within the first 10 days of the next month.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

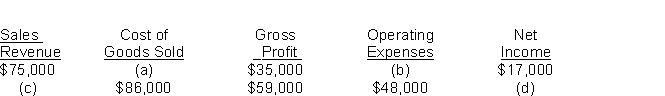

Presented here are the components in Bradley Company's income statement.Determine the missing amounts.

Correct Answer

verified

Correct Answer

verified

Essay

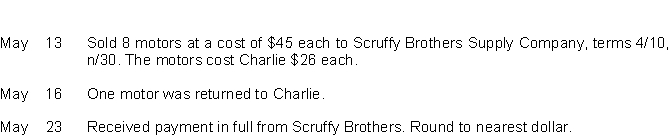

Charlie Company uses a perpetual inventory system.During May, the following transactions and events occurred.  Instructions

Journalize the May transactions for Charlie Company (seller) assuming that Charlie uses a perpetual inventory system.You may omit explanations.Round amounts to nearest dollar.

Instructions

Journalize the May transactions for Charlie Company (seller) assuming that Charlie uses a perpetual inventory system.You may omit explanations.Round amounts to nearest dollar.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial information is presented below:  The gross profit rate would be

The gross profit rate would be

A) .13.

B) .40.

C) .60.

D) .73.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Merchandisers apply the revenue recognition principle by recognizing sales revenues when the performance obligation is satisfied.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 202

Related Exams