A) $198,000

B) $158,400

C) $187,200

D) $234,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Schuepfer Incorporated bases its selling and administrative expense budget on budgeted unit sales. The sales budget shows 3,000 units are planned to be sold in March. The variable selling and administrative expense is $3.50 per unit. The budgeted fixed selling and administrative expense is $35,800 per month, which includes depreciation of $4,500 per month. The remainder of the fixed selling and administrative expense represents current cash flows. The cash disbursements for selling and administrative expenses on the March selling and administrative expense budget should be:

A) $46,300

B) $41,800

C) $31,300

D) $10,500

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Zolezzi Incorporated is preparing its cash budget for March. The budgeted beginning cash balance is $42,000. Budgeted cash receipts total $178,000 and budgeted cash disbursements total $175,000. The desired ending cash balance is $50,000. The company can borrow up to $160,000 at any time from a local bank, with interest not due until the following month.Required:Prepare the company's cash budget for March in good form. Make sure to indicate what borrowing, if any, would be needed to attain the desired ending cash balance.

Correct Answer

verified

Correct Answer

verified

True/False

The master budget consists of a number of separate but interdependent budgets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Douglas Corporation plans to sell 24,000 units of Product A during July and 30,000 units during August. Sales of Product A during June were 25,000 units. Past experience has shown that end-of-month inventory should equal 3,000 units plus 30% of the next month's sales. On June 30 this requirement was met. Based on these data, how many units of Product A must be produced during the month of July?

A) 28,800

B) 22,200

C) 24,000

D) 25,800

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

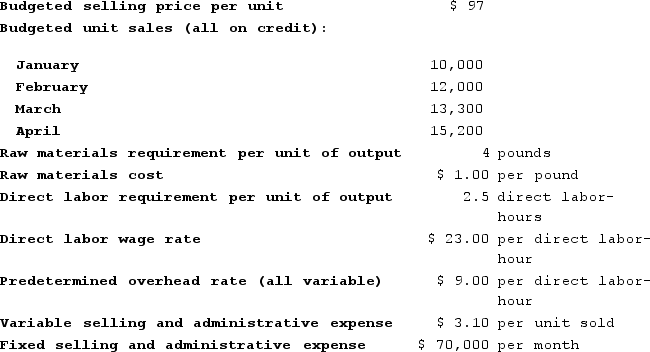

Bonkowski Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:  Credit sales are collected:30% in the month of the sale70% in the following monthRaw materials purchases are paid:30% in the month of purchase70% in the following monthThe ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.The estimated selling and administrative expense for February is closest to:

Credit sales are collected:30% in the month of the sale70% in the following monthRaw materials purchases are paid:30% in the month of purchase70% in the following monthThe ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.The estimated selling and administrative expense for February is closest to:

A) $71,470

B) $37,200

C) $107,200

D) $70,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

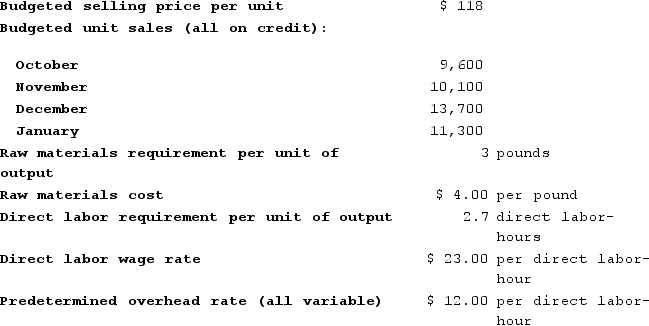

Fuson Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:  Credit sales are collected:30% in the month of the sale70% in the following monthRaw materials purchases are paid:30% in the month of purchase70% in the following monthThe ending finished goods inventory should equal 10% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.The budgeted accounts receivable balance at the end of November is closest to:

Credit sales are collected:30% in the month of the sale70% in the following monthRaw materials purchases are paid:30% in the month of purchase70% in the following monthThe ending finished goods inventory should equal 10% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.The budgeted accounts receivable balance at the end of November is closest to:

A) $795,000

B) $357,540

C) $1,191,800

D) $834,260

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

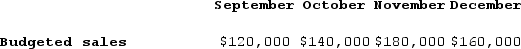

Budgeted sales in Acer Corporation over the next four months are given below:  Thirty percent of the company's sales are for cash and 70% are on account. Collections for sales on account follow a stable pattern as follows: 50% of a month's credit sales are collected in the month of sale, 30% are collected in the month following sale, and 20% are collected in the second month following sale. Given these data, cash collections for December should be:

Thirty percent of the company's sales are for cash and 70% are on account. Collections for sales on account follow a stable pattern as follows: 50% of a month's credit sales are collected in the month of sale, 30% are collected in the month following sale, and 20% are collected in the second month following sale. Given these data, cash collections for December should be:

A) $141,800

B) $100,500

C) $118,700

D) $161,400

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

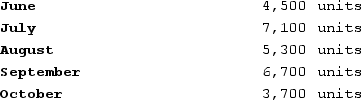

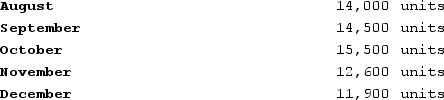

Roberts Enterprises has budgeted sales in units for the next five months as follows:  Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units. The inventory on May 31 contained 450 units. The company needs to prepare a production budget for the second quarter of the year.The beginning inventory in units for September is:

Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units. The inventory on May 31 contained 450 units. The company needs to prepare a production budget for the second quarter of the year.The beginning inventory in units for September is:

A) 370 units

B) 6,700 units

C) 530 units

D) 670 units

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Litzinger Corporation makes one product. The ending raw materials inventory should equal 20% of the following month's raw materials production needs. Each unit of finished goods requires 4 pounds of raw materials. The raw materials cost $1.00 per pound. The company estimates that it will need 53,720 pounds of raw material to satisfy production needs in June. The raw materials inventory balance at the end of May should be closest to:

A) $10,744

B) $7,984

C) $50,664

D) $42,680

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Petrini Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations:The budgeted selling price per unit is $110. Budgeted unit sales for January, February, March, and April are 7,500, 10,600, 12,000, and 11,700 units, respectively. All sales are on credit.Regarding credit sales, 30% are collected in the month of the sale and 70% in the following month.The ending finished goods inventory equals 30% of the following month's sales.The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $4.00 per pound.Regarding raw materials purchases, 40% are paid for in the month of purchase and 60% in the following month.The direct labor wage rate is $23.00 per hour. Each unit of finished goods requires 2.6 direct labor-hours.Manufacturing overhead is entirely variable and is $8.00 per direct labor-hour.The variable selling and administrative expense per unit sold is $1.70. The fixed selling and administrative expense per month is $70,000.The estimated net operating income (loss) for February is closest to:

A) $11,620

B) $81,620

C) $41,000

D) $29,640

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The direct labor budget shows the direct labor-hours required to satisfy the production budget.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

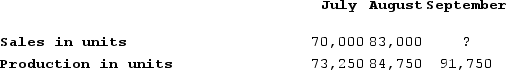

Frolic Corporation has budgeted sales and production over the next quarter as follows:  The company has 17,500 units of product on hand at July 1. 25% of the next month's sales in units should be on hand at the end of each month. October sales are expected to be 97,000 units. Budgeted sales for September would be (in units) :

The company has 17,500 units of product on hand at July 1. 25% of the next month's sales in units should be on hand at the end of each month. October sales are expected to be 97,000 units. Budgeted sales for September would be (in units) :

A) 88,000

B) 90,000

C) 86,000

D) 84,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The disbursements section of a cash budget consists of all cash payments for the period except cash payments for dividends. A) the direct materials purchase budget. B) the budgeted income statement. C) the sales forecast or sales budget. D) the production budget.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A benefit from budgeting is that it forces managers to think about and plan for the future.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The manufacturing overhead budget at Franklyn Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 4,400 direct labor-hours will be required in January. The variable overhead rate is $1.30 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $60,280 per month, which includes depreciation of $17,160. All other fixed manufacturing overhead costs represent current cash flows. The January cash disbursements for manufacturing overhead on the manufacturing overhead budget should be:

A) $5,720

B) $43,120

C) $48,840

D) $66,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Bandeiras Corporation, a merchandising firm, has budgeted its activity for December according to the following information:Sales at $550,000, all for cash.Merchandise inventory on November 30 was $300,000.The cash balance at December 1 was $25,000.Selling and administrative expenses are budgeted at $60,000 for December and are paid in cash.Budgeted depreciation for December is $35,000.The planned merchandise inventory on December 31 is $270,000.The cost of goods sold is 75% of the sales price.All purchases are paid for in cash.There is no interest expense or income tax expense.The budgeted net income for December is:

A) $107,500

B) $137,500

C) $42,500

D) $77,500

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The manufacturing overhead budget lists all costs of production other than direct materials and direct labor.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The production budget is typically prepared before the direct materials budget.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Coles Corporation, Incorporated makes and sells a single product, Product R. Three yards of Material K are needed to make one unit of Product R. Budgeted production of Product R for the next five months is as follows:  The company wants to maintain monthly ending inventories of Material K equal to 20% of the following month's production needs. On July 31, this requirement was not met since only 2,500 yards of Material K were on hand. The cost of Material K is $0.85 per yard. The company wants to prepare a Direct Materials Purchase Budget for the rest of the year.The desired ending inventory of Material K for September is:

The company wants to maintain monthly ending inventories of Material K equal to 20% of the following month's production needs. On July 31, this requirement was not met since only 2,500 yards of Material K were on hand. The cost of Material K is $0.85 per yard. The company wants to prepare a Direct Materials Purchase Budget for the rest of the year.The desired ending inventory of Material K for September is:

A) 7,560 yards

B) 8,400 yards

C) 8,700 yards

D) 9,300 yards

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 284

Related Exams