A) Preferred stock generally has a higher component cost of capital to the firm than does common stock.

B) By law in most states, all preferred stock must be cumulative, meaning that the compounded total of all unpaid preferred dividends must be paid before any dividends can be paid on the firm's common stock.

C) From the issuer's point of view, preferred stock is less risky than bonds.

D) Whereas common stock has an indefinite life, preferred stocks always have a specific maturity date, generally 25 years or less.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stock typically has a par value, and the dividend is often stated as a percentage of par. The par value is also important in the event of liquidation, as the preferred stockholders are generally entitled to receive the par value before anything is given to the common stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stock can provide a financing alternative for some firms when market conditions are such stat they cannot issue either pure debt or common stock at any reasonable cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Curry Corporation is setting the terms on a new issue of bonds with warrants. The bonds will have a 30-year maturity and annual interest payments. Each bond will come with 20 warrants that give the holder the right to purchase one share of stock per warrant. The investment bankers estimate that each warrant will have a value of $10.00. A similar straight-debt issue would require a 10% coupon. What coupon rate should be set on the bonds-with-warrants so that the package would sell for $1,000?

A) 6.75%

B) 7.11%

C) 7.48%

D) 7.88%

E) 8.27%

G) None of the above

Correct Answer

verified

D

Correct Answer

verified

True/False

A warrant holder is not entitled to vote, but he or she does receive any cash dividends paid on the underlying stock.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stockholders have priority over common stockholders with respect to dividends, because dividends must be paid on preferred stock before they can be paid on common stock. However, preferred and common stockholders normally have equal priority with respect to liquidating proceeds in the event of bankruptcy.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

A detachable warrant is a warrant that can be detached and traded separately from the bond with which it was issued. Most traded warrants are originally attached to bonds or preferred stocks.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about convertibles is most CORRECT?

A) The coupon interest rate on a firm's convertibles is generally set higher than the market yield on its otherwise similar straight debt.

B) One advantage of convertibles over warrants is that the issuer receives additional cash money when convertibles are converted.

C) Investors are willing to accept a lower interest rate on a convertible than on otherwise similar straight debt because convertibles are less risky than straight debt.

D) At the time it is issued, a convertible's conversion (or exercise) price is generally set equal to or below the underlying stock's price.

E) For equilibrium to exist, the expected return on a convertible bond must normally be between the expected return on the firm's otherwise similar straight debt and the expected return on its common stock.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Valdes Enterprises is considering issuing a 10-year convertible bond that would be priced at its $1,000 par value. The bonds would have an 8.00% annual coupon, and each bond could be converted into 20 shares of common stock. The required rate of return on an otherwise similar nonconvertible bond is 10.00%. The stock currently sells for $40.00 a share, has an expected dividend in the coming year of $2.00, and has an expected constant growth rate of 5.00%. What is the estimated floor price of the convertible at the end of Year 3?

A) $794.01

B) $835.81

C) $879.80

D) $926.10

E) $972.41

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chocolate Factory's convertible debentures were issued at their $1,000 par value in 2009. At any time prior to maturity on February 1, 2029, a debenture holder can exchange a bond for 25 shares of common stock. What is the conversion price, Pc?

A) $40.00

B) $42.00

C) $44.10

D) $46.31

E) $48.62

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Unlike bonds, the cost of preferred stock to the issuing firm is the same on a before-tax and after-tax basis. This is because dividends on preferred stock are not tax deductible, whereas interest on bonds is deductible.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Orient Airlines' common stock currently sells for $33, and its 8% convertible debentures (issued at par, or $1,000) sell for $850. Each debenture can be converted into 25 shares of common stock at any time before 2019. What is the conversion value of the bond?

A) $707.33

B) $744.56

C) $783.75

D) $825.00

E) $866.25

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Many preferred stocks extend voting rights to preferred shareholders if the preferred dividend has been omitted for some specified period, for example, 4 quarters.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Upstate Water Company just sold a bond with 50 warrants attached. The bonds have a 20-year maturity and an annual coupon of 12%, and they were issued at their $1,000 par value. The current yield on similar straight bonds is 15%. What is the implied value of each warrant?

A) $3.76

B) $3.94

C) $4.14

D) $4.35

E) $4.56

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The problem of dilution of stockholders' earnings never results from the sale of call options, but it can arise if warrants are used.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most CORRECT?

A) Warrants have an option feature but convertibles do not.

B) One important difference between warrants and convertibles is that convertibles bring in additional funds when they are converted, but exercising warrants does not bring in any additional funds.

C) The coupon rate on convertible debt is normally set below the coupon rate that would be set on otherwise similar straight debt even though investing in convertibles is more risky than investing in straight debt.

D) The value of a warrant to buy a safe, stable stock should exceed the value of a warrant to buy a risky, volatile stock, other things held constant.

F) All of the above

Correct Answer

verified

C

Correct Answer

verified

True/False

The "preferred" feature of preferred stock means that it normally will provide a higher expected return than will common stock.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Most convertible securities are bonds or preferred stocks that, under specified terms and conditions, can be exchanged for common stock at the option of the holder.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

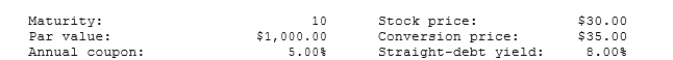

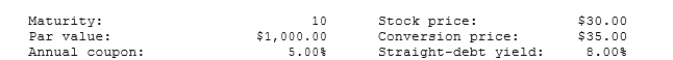

(The following data apply to Problems 27 through 30. The problems MUST be kept together.)

The following data apply to Saunders Corporation's convertible bonds:  -What is the bond's conversion value?

-What is the bond's conversion value?

A) $698.15

B) $734.89

C) $773.57

D) $814.29

E) $857.14

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(The following data apply to Problems 27 through 30. The problems MUST be kept together.)

The following data apply to Saunders Corporation's convertible bonds:  -Based on your answers to the three preceding questions, what is the minimum price (or "floor" price) at which the Saunders' bonds should sell?

-Based on your answers to the three preceding questions, what is the minimum price (or "floor" price) at which the Saunders' bonds should sell?

A) $698.15

B) $734.89

C) $773.57

D) $814.29

E) $857.14

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 30

Related Exams