A) 14.05%

B) 15.61%

C) 17.34%

D) 19.27%

E) 21.20%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one cash outflow at t = 0 followed by a series of positive cash flows.

A) A project's MIRR is always greater than its regular IRR.

B) A project's MIRR is always less than its regular IRR.

C) If a project's IRR is greater than its WACC, then its MIRR will be greater than the IRR.

D) To find a project's MIRR, we compound cash inflows at the regular IRR and then find the discount rate that causes the PV of the terminal value to equal the initial cost.

E) To find a project's MIRR, the textbook procedure compounds cash inflows at the WACC and then finds the discount rate that causes the PV of the terminal value to equal the initial cost.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

No conflict will exist between the NPV and IRR methods, when used to evaluate two equally risky but mutually exclusive projects, if the projects' cost of capital exceeds the rate at which the projects' NPV profiles cross.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

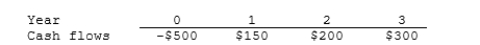

Susmel Inc. is considering a project that has the following cash flow Data. What is the project's payback?

A) 2.03 years

B) 2.25 years

C) 2.50 years

D) 2.75 years

E) 3.03 years

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

McCall Manufacturing has a WACC of 10%. The firm is considering two normal, equally risky, mutually exclusive, but not repeatable projects. The two projects have the same investment costs, but Project A has an IRR of 15%, while Project B has an IRR of 20%. Assuming the projects' NPV profiles cross in the upper right quadrant, which of the following statements is CORRECT?

A) Each project must have a negative NPV.

B) Since the projects are mutually exclusive, the firm should always select Project B.

C) If the crossover rate is 8%, Project B will have the higher NPV.

D) Only one project has a positive NPV.

E) If the crossover rate is 8%, Project A will have the higher NPV.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) A project's NPV is generally found by compounding the cash inflows at the WACC to find the terminal value (TV) , then discounting the TV at the IRR to find its PV.

B) The higher the WACC used to calculate the NPV, the lower the calculated NPV will be.

C) If a project's NPV is greater than zero, then its IRR must be less than the WACC.

D) If a project's NPV is greater than zero, then its IRR must be less than zero.

E) The NPVs of relatively risky projects should be found using relatively low WACCs.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) For a project with normal cash flows, any change in the WACC will change both the NPV and the IRR.

B) To find the MIRR, we first compound cash flows at the regular IRR to find the TV, and then we discount the TV at the WACC to find the PV.

C) The NPV and IRR methods both assume that cash flows can be reinvested at the WACC. However, the MIRR method assumes reinvestment at the MIRR itself.

D) If two projects have the same cost, and if their NPV profiles cross in the upper right quadrant, then the project with the higher IRR probably has more of its cash flows coming in the later years.

E) If two projects have the same cost, and if their NPV profiles cross in the upper right quadrant, then the project with the lower IRR probably has more of its cash flows coming in the later years.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When evaluating mutually exclusive projects, the modified IRR (MIRR) always leads to the same capital budgeting decisions as the NPV method, regardless of the relative lives or sizes of the projects being evaluated.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The NPV method is based on the assumption that projects' cash flows are reinvested at the project's risk-adjusted cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The shorter a project’s payback period, the less desirable the project is normally considered to be by this criterion.

B) One drawback of the regular payback is that this method does not take account of cash flows beyond the payback period.

C) If a project’s payback is positive, then the project should be accepted because it must have a positive NPV.

D) The regular payback ignores cash flows beyond the payback period, but the discounted payback method overcomes this problem.

E) One drawback of the discounted payback is that this method does not consider the time value of money, while the regular payback overcomes this drawback.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

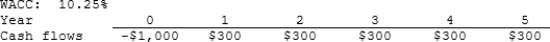

Harry's Inc. is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's expected NPV is negative, it should be rejected.

A) $105.89

B) $111.47

C) $117.33

D) $123.51

E) $130.01

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The phenomenon called "multiple internal rates of return" arises when two or more mutually exclusive projects that have different lives are compared to one another.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) The longer a project's payback period, the more desirable the project is normally considered to be by this criterion.

B) One drawback of the regular payback for evaluating projects is that this method does not properly account for the time value of money.

C) If a project's payback is positive, then the project should be rejected because it must have a negative NPV.

D) The regular payback ignores cash flows beyond the payback period, but the discounted payback method overcomes this problem.

E) If a company uses the same payback requirement to evaluate all projects, say it requires a payback of 4 years or less, then the company will tend to reject projects with relatively short lives and accept long-lived projects, and this will cause its risk to increase over time.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) A project’s NPV is found by compounding the cash inflows at the IRR to find the terminal value (TV) , then discounting the TV at the WACC.

B) The lower the WACC used to calculate a project’s NPV, the lower the calculated NPV will be.

C) If a project’s NPV is less than zero, then its IRR must be less than the WACC.

D) If a project’s NPV is greater than zero, then its IRR must be less than zero.

E) The NPV of a relatively low-risk project should be found using a relatively high WACC.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

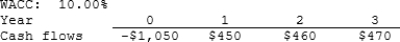

Cornell Enterprises is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's expected NPV can be negative, in which case it will be rejected.

A) $ 92.37

B) $ 96.99

C) $101.84

D) $106.93

E) $112.28

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a project with normal cash flows has an IRR greater than the WACC, the project must also have a positive NPV.

B) If Project A's IRR exceeds Project B's, then A must have the higher NPV.

C) A project's MIRR can never exceed its IRR.

D) If a project with normal cash flows has an IRR less than the WACC, the project must have a positive NPV.

E) If the NPV is negative, the IRR must also be negative.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Under normal conditions, a firm's expected ROE would probably be higher if it financed with short-term rather than with long-term debt, but using short-term debt would probably increase the firm's risk.

B) Conservative firms generally use no short-term debt and thus have zero current liabilities.

C) A short-term loan can usually be obtained more quickly than a long- term loan, but the cost of short-term debt is normally higher than that of long-term debt.

D) If a firm that can borrow from its bank at a 6% interest rate buys materials on terms of 2/10 net 30, and if it must pay by Day 30 or else be cut off, then we would expect to see zero accounts payable on its balance sheet.

E) If one of your firm's customers is "stretching" its accounts payable, this may be a nuisance but it will not have an adverse financial impact on your firm if the customer periodically pays off its entire balance.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the IRR of normal Project X is greater than the IRR of mutually exclusive (and also normal) Project Y, we can conclude that the firm should always select X rather than Y if X has NPV > 0.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For a project with one initial cash outflow followed by a series of positive cash inflows, the modified IRR (MIRR) method involves compounding the cash inflows out to the end of the project's life, summing those compounded cash flows to form a terminal value (TV), and then finding the discount rate that causes the PV of the TV to equal the project's cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The NPV method was once the favorite of academics and business executives, but today most authorities regard the MIRR as being the best indicator of a project's profitability.

B) If the cost of capital declines, this lowers a project's NPV.

C) The NPV method is regarded by most academics as being the best indicator of a project's profitability; hence, most academics recommend that firms use only this one method.

D) A project's NPV depends on the total amount of cash flows the project produces, but because the cash flows are discounted at the WACC, it does not matter if the cash flows occur early or late in the project's life.

E) The NPV and IRR methods may give different recommendations regarding which of two mutually exclusive projects should be accepted, but they always give the same recommendation regarding the acceptability of a normal, independent project.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 98

Related Exams