A) 11.7 days

B) 13.0 days

C) 14.4 days

D) 15.2 days

E) 16.7 days

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A promissory note is the document signed when a bank loan is executed, and it specifies financial aspects of the loan.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm sells on terms of 2/10 net 30 days, and its DSO is 28 days, then the fact that the 28-day DSO is less than the 30-day credit period tells us that the credit department is functioning efficiently and there are no past-due accounts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Not taking cash discounts is costly, and as a result, firms that do not take them are usually those that are performing poorly and have inadequate cash balances.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

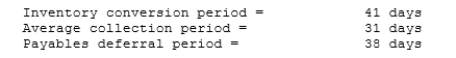

Whittington Inc. has the following data. What is the firm's cash conversion cycle?

A) 31 days

B) 34 days

C) 37 days

D) 41 days

E) 45 days

G) A) and B)

Correct Answer

verified

Correct Answer

verified

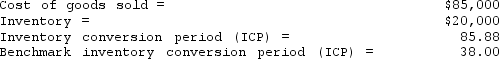

Multiple Choice

Data on Shin Inc. for 2008 are shown below, along with the inventory conversion period (ICP) of the firms against which it benchmarks. The firm's new CFO believes that the company could reduce its inventory enough to reduce its ICP to the benchmarks' average. If this were done, by how much would inventories decline? Use a 365-day year.

A) Project S must have a higher NPV than Project L.

B) If Project S has a positive NPV, Project L must also have a positive NPV.

C) If the WACC falls, each project's IRR will increase.

D) If the WACC increases, each project's IRR will decrease.

E) $11,151

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Although short-term interest rates have historically averaged less than long-term rates, the heavy use of short-term debt is considered to be an aggressive current operating asset financing strategy because of the inherent risks of using short-term financing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The overriding goal of inventory management is to ensure that the firm never suffers a stock-out, i.e., never runs out of an inventory item.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

One of the effects of ceasing to take trade credit discounts is that the firm's accounts payable will rise, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Atlanta Cement, Inc. buys on terms of 2/15, net 30. It does not take discounts, and it typically pays 60 days after the invoice date. Net purchases amount to $720,000 per year. What is the nominal annual percentage cost of its non-free trade credit, based on a 365-day year?

A) 10.86%

B) 12.07%

C) 13.41%

D) 14.90%

E) 16.55%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Long-term loan agreements always contain provisions, or covenants, that constrain the firm's future actions. Short-term credit agreements are just as restrictive in order to protect the interest of the lender.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Edison Inc. has annual sales of $36,500,000, or $100,000 a day on a 365-day basis. The firm's cost of goods sold is 75% of sales. On average, the company has $9,000,000 in inventory and $8,000,000 in accounts receivable. The firm is looking for ways to shorten its cash conversion cycle. Its CFO has proposed new policies that would result In a 20% reduction in both average inventories and accounts receivable. She also anticipates that these policies would reduce sales by 10%, while the payables deferral period would remain unchanged at 35 days. What effect would these policies have on the company's cash conversion cycle? Round to the nearest whole day.

A) -26 days

B) -22 days

C) -18 days

D) -14 days

E) -11 days

G) B) and D)

Correct Answer

verified

Correct Answer

verified

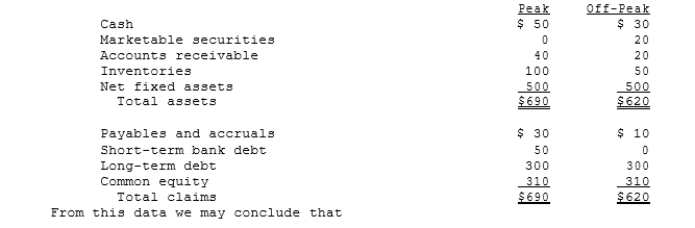

Multiple Choice

Swim Suits Unlimited is in a highly seasonal business, and the following summary balance sheet data show its assets and liabilities at peak and off-peak seasons (in thousands of dollars) :

A) Swim Suits' current asset financing policy calls for exactly matching asset and liability maturities.

B) Swim Suits' current asset financing policy is relatively aggressive; that is, the company finances some of its permanent assets with short-term discretionary debt.

C) Swim Suits follows a relatively conservative approach to current asset financing; that is, some of its short-term needs are met by permanent capital.

D) Without income statement data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

E) Without cash flow data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Edwards Enterprises follows a moderate current asset investment policy, but it is now considering a change, perhaps to a restricted or maybe to a relaxed policy. The firm's annual sales are $400,000; its fixed assets are $100,000; its target capital structure calls for 50% debt and 50% equity; its EBIT is $35,000; the interest rate on its debt is 10%; and its tax rate is 40%. With a restricted policy, current assets will be 15% of sales, while under a relaxed policy they will be 25% of sales. What is the difference in the projected ROEs between the restricted and relaxed policies?

A) 4.25%

B) 4.73%

C) 5.25%

D) 5.78%

E) 6.35%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Other things held constant, the higher a firm's days sales outstanding (DSO) , the better its credit department.

B) If a firm that sells on terms of net 30 changes its policy to 2/10 net 30, and if no change in sales volume occurs, then the firm's DSO will probably increase.

C) If a firm sells on terms of 2/10 net 30, and its DSO is 30 days, then the firm probably has some past-due accounts.

D) If a firm sells on terms of net 60, and if its sales are highly seasonal, with a sharp peak in December, then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in January than in July.

E) If a firm changed the credit terms offered to its customers from 2/10 net 30 to 2/10 net 60, then its sales should increase, and this should lead to an increase in sales per day, and that should lead to a decrease in the DSO.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The relative profitability of a firm that employs an aggressive current asset financing policy will improve if the yield curve changes from upward sloping to downward sloping.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gonzales Company currently uses maximum trade credit by not taking discounts on its purchases. The standard industry credit terms offered by all its suppliers are 2/10 net 30 days, and the firm pays on time. The new CFO is considering borrowing from its bank, using short-term notes payable, and then taking discounts. The firm wants to determine the effect of this policy change on its net income. Its net purchases are $11,760 per day, using a 365-day year. The interest rate on the notes payable is 10%, and the tax rate is 40%. If the firm implements the plan, what is the expected change in net income?

A) $32,964

B) $34,699

C) $36,526

D) $38,448

E) $40,370

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firms generally choose to finance temporary current operating assets with short-term debt because

A) matching the maturities of assets and liabilities reduces risk under some circumstances, and also because short-term debt is often less expensive than long-term capital.

B) short-term interest rates have traditionally been more stable than long-term interest rates.

C) a firm that borrows heavily on a long-term basis is more apt to be unable to repay the debt than a firm that borrows short term.

D) the yield curve is normally downward sloping.

E) short-term debt has a higher cost than equity capital.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nogueiras Corp's budgeted monthly sales are $5,000, and they are constant from month to month. 40% of its customers pay in the first month and take the 2% discount, while the remaining 60% pay in the month following the sale and do not receive a discount. The firm has no bad debts. Purchases for next month's sales are constant at 50% of projected sales for the next month. "Other payments," which include wages, rent, and taxes, are 25% of sales for the current month. Construct a cash budget for a typical month and calculate the average net cash flow during the month.

A) $1,092

B) $1,150

C) $1,210

D) $1,271

E) $1,334

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Roton Inc. purchases merchandise on terms of 2/15, net 40, and its gross purchases (i.e., purchases before taking off the discount) are $800,000 per year. What is the maximum dollar amount of costly trade credit the firm could get, assuming it abides by the supplier's credit terms? (Assume a 365-day year.)

A) $53,699

B) $56,384

C) $59,203

D) $62,163

E) $65,271

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 129

Related Exams