A) $77.19

B) $81.25

C) $85.31

D) $89.58

E) $94.06

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have a chance to buy an annuity that pays $5,000 at the beginning of each year for 5 years. You could earn 4.5% on your money in other 70) Investments with equal risk. What is the most you should pay for the annuity?

A) 20,701

B) $21,791

C) $22,938

D) $24,085

E) $25,289

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you inherited $275,000 and invested it at 8.25% per year. How much could you withdraw at the end of each of the next 20 years?

A) $28,532

B) $29,959

C) $31,457

D) $33,030

E) $34,681

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

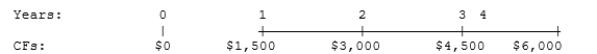

What is the present value of the following cash flow stream at a rate of 12.0%?

A) $9,699

B) $10,210

C) $10,747

D) $11,284

E) $11,849

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ten years ago, Spielberg Inc. earned $0.50 per share. Its earnings this year were $2.20. What was the growth rate in earnings per share (EPS) over the 10-year period?

A) 15.17%

B) 15.97%

C) 16.77%

D) 17.61%

E) 18.49%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you have $2,000 and plan to purchase a 10-year certificate of deposit (CD) that pays 6.5% interest, compounded annually. How much will you have when the CD matures?

A) $3,754.27

B) $3,941.99

C) $4,139.09

D) $4,346.04

E) $4,563.34

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a bank offers to lend you $10,000 for 1 year on a loan contract that calls for you to make interest payments of $250.00 at the end of each quarter and then pay off the principal amount at the end of the year. What is the effective annual rate on the loan?

A) 8.46%

B) 8.90%

C) 9.37%

D) 9.86%

E) 10.38%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the PV of an annuity due with 5 payments of $2,500 at an interest rate of 5.5%?

A) $11,262.88

B) $11,826.02

C) $12,417.32

D) $13,038.19

E) $13,690.10

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If you have a series of cash flows, each of which is positive, you can solve for I, where the solution value of I causes the PV of the cash flows to equal the cash flow at Time 0.

B) If you have a series of cash flows, and CF0 is negative but each of the following CFs is positive, you can solve for I, but only if the sum of the undiscounted cash flows exceeds the cost.

C) To solve for I, one must identify the value of I that causes the PV of the positive CFs to equal the absolute value of the FV of the negative CFs. It is impossible to find the value of I without a computer or financial calculator.

D) If you solve for I and get a negative number, then you must have made a mistake.

E) If CF0 is positive and all the other CFs are negative, then you can still solve for I.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You plan to borrow $35,000 at a 7.5% annual interest rate. The terms require you to amortize the loan with 7 equal end-of-year payments. How much interest would you be paying in Year 2?

A) $1,994.49

B) $2,099.46

C) $2,209.96

D) $2,326.27

E) $2,442.59

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Steve and Ed are cousins who were both born on the same day, and both turned 25 today. Their grandfather began putting $2,500 per year into a trust fund for Steve on his 20th birthday, and he just made a 6th payment into the fund. The grandfather (or his estate's trustee) will make 40 more $2,500 payments until a 46th and final payment is made on Steve's 65th birthday. The grandfather set things up this way because he wants Steve to work, not be a "trust fund baby," but he also wants to ensure that Steve is provided for in his old age. Until now, the grandfather has been disappointed with Ed, hence has not given him anything. However, they recently reconciled, and the grandfather decided to make an equivalent provision for Ed. He will make the first payment to a trust for Ed today, and he has instructed his trustee to make 40 additional equal annual payments until Ed turns 65, when the 41st and final payment will be made. If both trusts earn an annual return of 8%, how much must the grandfather put into Ed's trust today and each subsequent year to enable him to have the same retirement nest egg as Steve after the last payment is made on their 65th birthday?

A) $3,726

B) $3,912

C) $4,107

D) $4,313

E) $4,528

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT, assuming positive interest rates and holding other things constant?

A) The present value of a 5-year, $250 annuity due will be lower than the PV of a similar ordinary annuity.

B) A 30-year, $150,000 amortized mortgage will have larger monthly payments than an otherwise similar 20-year mortgage.

C) A bank loan's nominal interest rate will always be equal to or greater than its effective annual rate.

D) If an investment pays 10% interest, compounded quarterly, its effective annual rate will be greater than 10%.

E) Banks A and B offer the same nominal annual rate of interest, but A pays interest quarterly and B pays semiannually. Deposits in Bank B will provide the higher future value if you leave your funds on deposit.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Farmers Bank offers to lend you $50,000 at a nominal rate of 5.0%, simple interest, with interest paid quarterly. Merchants Bank offers to lend you the $50,000, but it will charge 6.0%, simple interest, with interest paid at the end of the year. What's the difference in the effective annual rates charged by the two banks?

A) 1.56%

B) 1.30%

C) 1.09%

D) 0.91%

E) 0.72%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your bank offers to lend you $100,000 at an 8.5% annual interest rate to start your new business. The terms require you to amortize the loan with 10 equal end-of-year payments. How much interest would you be paying in Year 2?

A) $7,531

B) $7,927

C) $8,323

D) $8,740

E) $9,177

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Starting to invest early for retirement reduces the benefits of compound interest.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the U.S. Treasury offers to sell you a bond for $747.25. No payments will be made until the bond matures 5 years from now, at which time it will be redeemed for $1,000. What interest rate would you earn if you bought this bond at the offer price?

A) 4.37%

B) 4.86%

C) 5.40%

D) 6.00%

E) 6.60%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What's the present value of a perpetuity that pays $250 per year if the appropriate interest rate is 5%?

A) $4,750

B) $5,000

C) $5,250

D) $5,513

E) $5,788

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

All other things held constant, the present value of a given annual annuity increases as the number of periods per year increases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your Aunt Elsa has $500,000 invested at 6.5%, and she plans to retire. She wants to withdraw $40,000 at the beginning of each year, starting immediately. What is the maximum number of whole payments that can be withdrawn before the account is exhausted; i.e., before the account balance would become negative? (Hint: Round down to the nearest whole number.)

A) 18

B) 19

C) 20

D) 21

E) 22

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You plan to invest some money in a bank account. Which of the following banks provides you with the highest effective rate of interest?

A) Bank 1; 6.1% with annual compounding.

B) Bank 2; 6.0% with monthly compounding.

C) Bank 3; 6.0% with annual compounding.

D) Bank 4; 6.0% with quarterly compounding.

E) Bank 5; 6.0% with daily (365-day) compounding.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 139

Related Exams