A) is divided into at least two parts: share capital and retained earnings.

B) consists of two parts: common and preferred shares.

C) reflects two parts: dividends declared and share capital.

D) reflects retained earnings only.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Liquidity ratios are concerned with the frequency and amounts of dividend payments.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

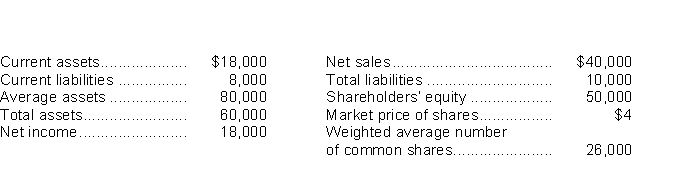

Use the following information to answer questions

-What is the debt to total assets?

-What is the debt to total assets?

A) 12.5%

B) 20.0%

C) 75.0%

D) 16.7%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Long-term investments appear in the property, plant, and equipment section of the statement of financial position.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Materiality and relevance are both defined in terms of what influences or makes a difference to a decision maker.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Consistency aids comparability when a company uses the same accounting principles and methods from year to year or when companies with similar circumstances use the same accounting principles.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The statement of financial position is normally presented as follows, when listed in order of liquidity: Current assets, current liabilities, non-current assets, non-current liabilities, and shareholders' equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The key components of the conceptual framework include

A) the objective of financial reporting, qualitative characteristics, the going concern assumption, elements of financial statements and the measurement of those elements.

B) the objective of financial reporting, qualitative characteristics, the going concern assumption, and elements of financial statements.

C) the objective of financial reporting, qualitative characteristics, the going concern assumption, and measurement of the elements of financial statements.

D) the objective of financial reporting, qualitative characteristics and the going concern assumption.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Elements of financial statements include assets, equity, and expenses, but not liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A liquidity ratio measures the

A) net income or operating success of a company over a period of time.

B) ability of a company to survive over a long period of time.

C) short-term ability of a company to pay its maturing obligations and to meet unexpected needs for cash.

D) percentage of total financing provided by creditors.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Working capital is a measure of

A) comparability.

B) liquidity.

C) profitability.

D) solvency.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A measure of profitability is the

A) current ratio.

B) debt to total assets ratio.

C) basic earnings per share.

D) working capital.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not normally be classified as a non-current liability?

A) current portion of non-current debt

B) bonds payable

C) mortgage payable

D) lease liabilities

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A single ratio by itself is not very meaningful.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) A current ratio of 1.2 to 1 indicates that a company's current assets are less than its current liabilities.

B) All companies, regardless of size, should have a current ratio of at least 2:1.

C) The current ratio is a more dependable indicator of liquidity than working capital.

D) The use of the current ratio does not make it possible to compare companies of different sizes.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an enhancing qualitative characteristic?

A) verifiability

B) faithful representation

C) comparability

D) timeliness

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current ratio is calculated as

A) current assets plus current liabilities.

B) current assets minus current liabilities.

C) current assets divided by current liabilities.

D) current assets times current liabilities.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Working capital is

A) the difference between total assets and current liabilities.

B) the excess of current assets over current liabilities.

C) the difference between current assets and total liabilities.

D) the excess of total assets over total liabilities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a constraint in accounting?

A) comparability

B) cost

C) faithful representation

D) timeliness

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Comparability in accounting means that a company uses the same generally accepted accounting principles from one accounting period to the next.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 129

Related Exams