A) Current ratio

B) Working capital

C) Debt to assets ratio

D) Each of these answer choices are liquidity measures.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Profitability means having enough funds on hand to pay debts when they fall due.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jackson Cement Corporation reported $35 million for sales when it only had $20 million of actual sales.Which of the following qualities of useful information has Jackson most likely violated?

A) Comparability

B) Relevance

C) Faithful representation

D) Consistency

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The periodicity assumption states that every economic entity can be separately identified and accounted for.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The most generally accepted value used to report assets in accounting is fair value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It is assumed that the activities of Ford Motor company can be distinguished from those of General Motors because of the

A) going concern assumption.

B) economic entity assumption.

C) monetary unit assumption.

D) periodicity assumption.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current assets divided by current liabilities is known as the

A) working capital.

B) current ratio.

C) profit margin.

D) capital structure.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Long-term creditors are usually most interested in evaluating

A) liquidity.

B) profitability.

C) solvency.

D) consistency.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

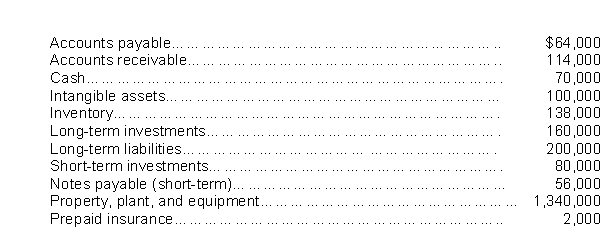

Based on the following data, what is the amount of working capital?

A) $284,000

B) $332,000

C) $370,000

D) $326,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ace Company is a retail store.Due to competition, it is having trouble selling its products.Thus, inventory has been building up.Ace's current ratio has not changed for the past three years, in spite of the inventory buildup.Which of the following statements is true?

A) As long as the current ratio remains constant, there is no need for concern.

B) The composition of current assets and current liabilities does not matter.

C) The management of Ace should consider the effect of slow moving inventory on its liquidity.

D) Since inventory is a current asset, any increases should automatically cause the current ratio to rise.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Earnings per share is calculated by dividing

A) gross profit by average common shares outstanding.

B) (net income less preferred dividends) by average common shares outstanding.

C) net income by average common shares outstanding.

D) net sales by average common shares outstanding.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Solvency ratios measure the ability of a company to survive over a short period of time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On a classified balance sheet, short-term investments are classified as

A) intangible assets.

B) property, plant, and equipment.

C) current assets.

D) long-term investments.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A useful measure of solvency is the

A) current ratio.

B) earnings per share.

C) return on assets ratio.

D) debt to assets ratio.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ratios that measure the income or operating success of a company for a given period of time are

A) liquidity ratios.

B) profitability ratios.

C) solvency ratios.

D) trending ratios.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The relationship between current assets and current liabilities is important in evaluating a company's

A) profitability.

B) liquidity.

C) market value.

D) solvency.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The historical cost principle requires that when assets are acquired, they be recorded at

A) fair market value.

B) the amount paid for them.

C) selling price.

D) list price.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How can a company improve its current ratio?

A) Work with a creditor to reclassify some current debt into long-term debt

B) Collect accounts receivable

C) Nothing can ethically be done to improve the current ratio

D) Use excess cash to buy new equipment

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Working capital is a measure of

A) consistency.

B) liquidity.

C) profitability.

D) solvency.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounting information should be verifiable in order to enhance

A) comparability.

B) faithful representation.

C) consistency.

D) relevance.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 191

Related Exams