B) False

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant, a decline in sales and a simultaneous increase in financial leverage must result in a lower profit margin.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Suppose a firm wants to maintain a specific TIE ratio. It knows the amount of its debt, the interest rate on that debt, the applicable tax rate, and its operating costs. With this information, the firm can calculate the amount of sales required to achieve its target TIE ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The use of debt financing will tend to lower the basic earning power ratio, other things held constant.

B) A firm that employs financial leverage will have a higher equity multiplier than an otherwise identical firm that has no debt in its capital structure.

C) If two firms have identical sales, interest rates paid, operating costs, and assets, but differ in the way they are financed, the firm with less debt will generally have the higher expected ROE.

D) Holding bonds is better than holding stock for investors because income from bonds is taxed on a more favourable basis than income from stock.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The average collection period tells how many days it takes a business to pay money for trade credits to its suppliers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You observe that a firm's ROE is above the industry average, but its profit margin and debt ratio are both below the industry average. Which of the following statements is correct?

A) Its total assets turnover must be above the industry average.

B) Its return on assets must equal the industry average.

C) Its TIE ratio must be below the industry average.

D) Its total assets turnover must be below the industry average.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) If a firm has the highest price/earnings ratio of any firm in its industry, then, other things held constant, this suggests that the board of directors should fire the president.

B) If a firm has the highest market/book ratio of any firm in its industry, then, other things held constant, this suggests that the board of directors should fire the president.

C) Other things held constant, the higher a firm's expected future growth rate, the lower its P/E ratio is likely to be.

D) The higher the market/book ratio, then, other things held constant, the higher one would expect to find the Market Value Added (MVA) .

F) A) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

LeCompte Corp. has $312,900 of assets, and it uses only common equity capital (zero debt) . Its sales for the last year were $620,000, and its net income after taxes was $24,655. Stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15%. What profit margin would LeCompte need in order to achieve the 15% ROE, holding everything else constant?

A) 7.57%

B) 7.95%

C) 8.35%

D) 8.76%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would, generally, indicate an improvement in a company's financial position, other things held constant?

A) The TIE declines.

B) The DSO increases.

C) The EBITDA coverage ratio increases.

D) The current and quick ratios both decline.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The times-interest-earned ratio is one, but not the only, indication of a firm's ability to meet its long- term and short-term debt obligations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

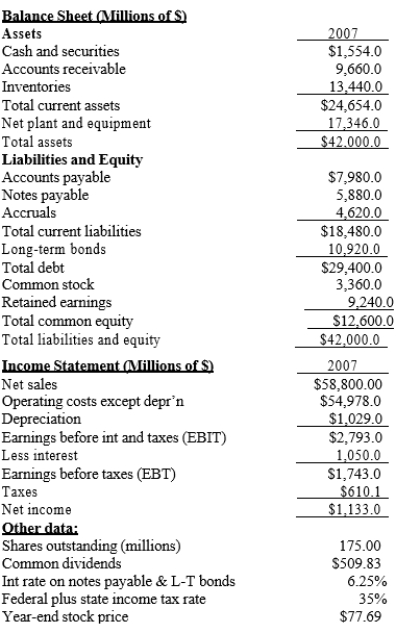

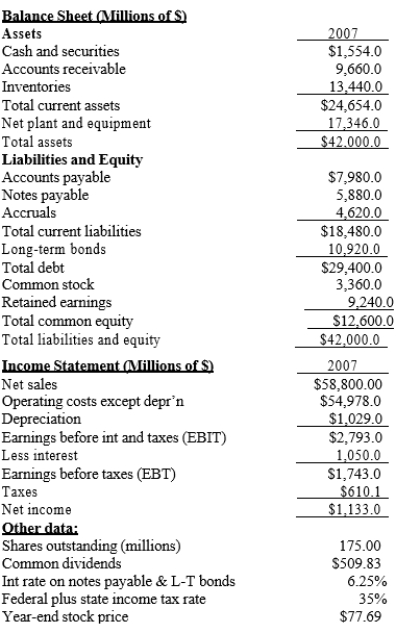

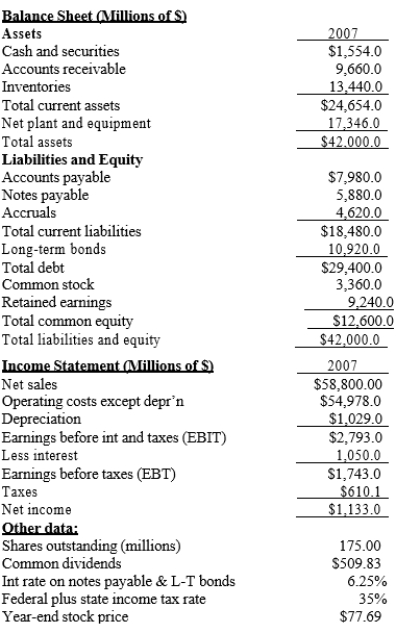

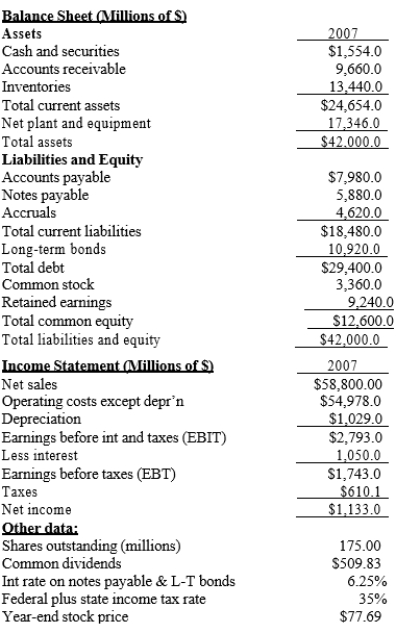

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.  -What is the firm's ROA?

-What is the firm's ROA?

A) 2.70%

B) 2.97%

C) 3.26%

D) 3.59%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wants to strengthen its financial position. Which of the following actions would increase its current ratio?

A) Use cash to repurchase some of the company's own stock.

B) Borrow using short-term debt and use the proceeds to repay debt that has a maturity of more than 1 year.

C) Issue new stock and then use some of the proceeds to purchase additional inventory and hold the remainder as cash.

D) Use cash to increase inventory holdings.

F) A) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Helmuth Inc.'s latest net income was $1,250,000, and it had 225,000 shares outstanding. The company wants to pay out 45% of its income. What dividend per share should it declare?

A) $2.14

B) $2.26

C) $2.38

D) $2.50

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.  -What is the firm's book value per share?

-What is the firm's book value per share?

A) $61.73

B) $64.98

C) $68.40

D) $72.00

F) B) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Harper Corp.'s sales last year were $395,000, and its year-end receivables were $42,500. Harper sells on terms that call for customers to pay 30 days after the purchase, but many delay payment beyond Day 30. On average, how many days late do customers pay? Base your answer on this equation: DSO - Allowed credit period = Average days late, and use a 365-day year when calculating the DSO.

A) 7.95

B) 8.37

C) 8.81

D) 9.27

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.  -What is the firm's debt ratio?

-What is the firm's debt ratio?

A) 51.03%

B) 56.70%

C) 63.00%

D) 70.00%

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Firms A and B have the same current ratio, 0.75, the same amount of sales, and the same amount of current liabilities. However, Firm A has a higher inventory than B. Therefore, we can conclude that A's quick ratio must be smaller than B's.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.  -What is the firm's TIE?

-What is the firm's TIE?

A) 1.94

B) 2.15

C) 2.39

D) 2.66

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Branch Corp.'s total assets at the end of last year were $315,000 and its net income after taxes was $22,750. What was its return on total assets?

A) 7.22%

B) 7.58%

C) 7.96%

D) 8.36%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Walter Industries' current ratio is 0.5. Considered alone, which of the following actions would increase the company's current ratio?

A) Borrow using short-term notes payable and use the cash to increase inventories.

B) Use cash to reduce accruals.

C) Use cash to reduce accounts payable.

D) Use cash to reduce short-term notes payable.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 108

Related Exams