A) Products or services with high volumes will have higher overhead costs.

B) Products or services with high volumes will have lowered overhead costs.

C) Products or services with low volumes will have lowered overhead costs.

D) Products or services with high volumes are generally costed accurately.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a facility-level activity?

A) The Human Resources Department

B) The Product Manager's salary

C) Insurance on the factory that is used exclusively to manufacture one of the company's seven products

D) Inspections

F) None of the above

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Value-added activities

A) should be reduced or eliminated.

B) involve resource usage customers are willing to pay for.

C) add cost to a product without affecting selling price.

D) cannot be differentiated from non-value-added activities.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Painting is a product-level activity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of Astro Fireworks Company's activity cost pools is machine setups, with estimated overhead of $200,000.Astro produces sparklers (75 setups) and lighters (25 setups) .How much of the machine setup cost pool should be assigned to sparklers?

A) $50,000

B) $150,000

C) $166,666

D) $200,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

ABC leads to enhanced control over overhead costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer questions Sleep-Tight manufactures mattresses for the hotel industry.It has two products, Downy and Firm and total overhead of $504,000.The company plans to manufacture 200 Downy mattresses and 300 Firm mattresses this year.In manufacturing the mattresses, the company must perform 700 material moves for the Downy and 300 for the Firm; it processes 114 purchase orders for the Downy and 90 for the Firm; and the company's employees work 2,800 direct labour hours on the Downy product and 3,500 on the Firm.Sleep-Tight's total material handling costs are $300,000 and its total purchasing costs are $204,000. -Using ABC, how much overhead would be assigned to the Downy product?

A) $504,000

B) $324,000

C) $252,000

D) $180,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer questions

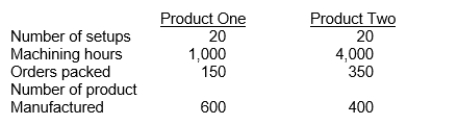

Poodle Company manufactures two products, Mini A and Maxi B.Poodle's overhead costs consist of setting up machines, $800,000; machining, $2,000,000; and inspecting, $600,000.Information on the two products is:  -Overhead applied to Mini A using activity-based costing is

-Overhead applied to Mini A using activity-based costing is

A) $1,275,000.

B) $1,536,000.

C) $1,760,000.

D) $1,920,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Canterra Co.incurs $160,000 of overhead costs each year in its three main departments, setup ($10,000) , machining ($110,000) , and packing ($40,000) .The setup department performs 40 setups per year, the machining department works 5,000 hours per year, and the packing department packs 500 orders per year.Information about Canterra's 2 products is as follows:  Using ABC, how much overhead is assigned to Product Two each year?

Using ABC, how much overhead is assigned to Product Two each year?

A) $80,000

B) $64,000

C) $121,000

D) $128,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A cost driver does not generally have a direct cause-effect relationship with the resources consumed.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jaime Inc.manufactures 2 products, sweaters and jackets.The company has estimated its overhead in the order-processing department to be $180,000.The company produces 50,000 sweaters and 80,000 jackets each year.Sweater production requires 25,000 machine hours, jacket production requires 50,000 machine hours.The company places raw materials orders 10 times per month, 2 times for raw materials for sweaters and the remainder for raw materials for jackets.How much of the order processing overhead should be allocated to jackets?

A) $90,000

B) $120,000

C) $110,770

D) $144,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a benefit of activity-based costing?

A) More accurate product costing

B) Enhanced control over overhead costs

C) Better management decisions

D) Less costly to use

F) None of the above

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

When using a single cost driver to allocate overhead costs, the amount of overhead costs that are applied is

A) usually greater for low-volume products than for high-volume products.

B) usually greater for high-volume products than for low-volume products.

C) usually equal for both low and high-volume products.

D) sometimes greater for higher-volume products, and sometimes greater for low-volume products.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A well-designed activity-based costing system starts with

A) identifying the activity-cost pools.

B) computing the activity-based overhead rate.

C) assigning manufacturing overhead costs for each activity cost pool to products.

D) analyzing the activities performed to manufacture a product.

F) A) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

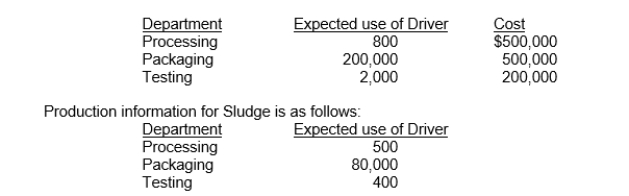

A company incurs $1,200,000 of overhead each year in three departments, Processing, Packaging, and Testing.The company performs 800 processing transactions, 200,000 packaging transactions, and 2,000 tests per year in producing 400,000 drums of Oil and 600,000 drums of Sludge.The following data are available:  Calculate the amount of overhead assigned to Sludge.

Calculate the amount of overhead assigned to Sludge.

A) $600,000

B) $552,500

C) $647,500

D) $460,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Any activity that increases the cost of producing a product is a value-added activity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer questions

Poodle Company manufactures two products, Mini A and Maxi B.Poodle's overhead costs consist of setting up machines, $800,000; machining, $2,000,000; and inspecting, $600,000.Information on the two products is:  -Overhead applied to Maxi B using activity-based costing is

-Overhead applied to Maxi B using activity-based costing is

A) $1,280,000.

B) $1,640,000.

C) $1,664,000.

D) $2,125,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Not all activities labelled non-value-added are totally wasteful, nor can they be totally eliminated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cost driver is

A) any factor or activity that has a direct cause-effect relationship with the resources consumed.

B) always based on time consumed by the activity.

C) another name for cost pool.

D) a term used only in traditional costing systems.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A critical component of an activity-based accounting system is:

A) The ability to accurately measure activities that consume cost.

B) Few areas in the facility that capture costs.

C) The ability to eliminate non-value-added activities.

D) Flexible job-order costing information.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 81

Related Exams