B) False

Correct Answer

verified

Correct Answer

verified

True/False

If investors' aversion to risk rose,causing the slope of the SML to increase,this would have a greater impact on the required rate of return on equity,rs,than on the interest rate on long-term debt,rd,for most firms.Other things held constant,this would lead to an increase in the use of debt and a decrease in the use of equity.However,other things would not stay constant if firms used a lot more debt,as that would increase the riskiness of both debt and equity and thus limit the shift toward debt.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a consultant to Basso Inc.,you have been provided with the following data: D1 = $0.67; P0 = $27.50; and g = 8.00% (constant) .What is the cost of common from reinvested earnings based on the DCF approach?

A) 9.42%

B) 9.91%

C) 10.44%

D) 10.96%

E) 11.51%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of debt is equal to one minus the marginal tax rate multiplied by the average coupon rate on all outstanding debt.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are a finance intern at Chambers and Sons and they have asked you to help estimate the company's cost of common equity.You obtained the following data: D1 = $1.25; P0 = $27.50; g = 5.00% (constant) ; and F = 6.00%.What is the cost of equity raised by selling new common stock?

A) 9.06%

B) 9.44%

C) 9.84%

D) 10.23%

E) 10.64%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

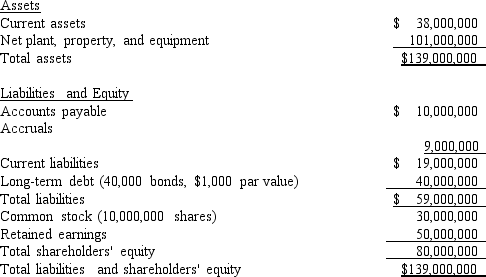

Exhibit 9.1

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 9.1.What is the best estimate of the firm's WACC?

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 9.1.What is the best estimate of the firm's WACC?

A) 10.85%

B) 11.19%

C) 11.53%

D) 11.88%

E) 12.24%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume a company's target capital structure is 50% debt and 50% common equity.

A) The WACC is calculated on a before-tax basis.

B) The WACC exceeds the cost of equity.

C) The cost of equity is always equal to or greater than the cost of debt.

D) The cost of reinvested earnings typically exceeds the cost of new common stock.

E) The interest rate used to calculate the WACC is the average after-tax cost of all the company's outstanding debt as shown on its balance sheet.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of common equity obtained by retaining earnings is the rate of return the marginal stockholder requires on the firm's common stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have been hired by the CFO of Lugones Industries to help estimate its cost of common equity.You have obtained the following data: (1) rd = yield on the firm's bonds = 7.00% and the risk premium over its own debt cost = 4.00%.(2) rRF = 5.00%,RPM = 6.00%,and b = 1.25.(3) D1 = $1.20,P0 = $35.00,and g = 8.00% (constant) .You were asked to estimate the cost of common based on the three most commonly used methods and then to indicate the difference between the highest and lowest of these estimates.What is that difference?

A) 1.13%

B) 1.50%

C) 1.88%

D) 2.34%

E) 2.58%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of equity raised by retaining earnings can be less than,equal to,or greater than the cost of external equity raised by selling new issues of common stock,depending on tax rates,flotation costs,the attitude of investors,and other factors.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Suppose you are the president of a small,publicly-traded corporation.Since you believe that your firm's stock price is temporarily depressed,all additional capital funds required during the current year will be raised using debt.In this case,the appropriate marginal cost of capital for use in capital budgeting during the current year is the after-tax cost of debt.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taylor Inc.estimates that its average-risk projects have a WACC of 10%,its below-average risk projects have a WACC of 8%,and its above-average risk projects have a WACC of 12%.Which of the following projects (A,B,and C) should the company accept?

A) Project C, which is of above-average risk and has a return of 11%.

B) Project A, which is of average risk and has a return of 9%.

C) None of the projects should be accepted.

D) All of the projects should be accepted.

E) Project B, which is of below-average risk and has a return of 8.5%.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of debt,rd,is normally less than rs,so rd(1 - T)will normally be much less than rs.Therefore,as long as the firm is not completely debt financed,the weighted average cost of capital (WACC)will normally be greater than rd(1 - T).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Acme Industries correctly estimates its WACC at a given point in time and then uses that same cost of capital to evaluate all projects for the next 10 years,then the firm will most likely

A) become less risky over time, and this will maximize its intrinsic value.

B) accept too many low-risk projects and too few high-risk projects.

C) become more risky and also have an increasing WACC. Its intrinsic value will not be maximized.

D) continue as before, because there is no reason to expect its risk position or value to change over time as a result of its use of a single cost of capital.

E) become riskier over time, but its intrinsic value will be maximized.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the firm is a publicly-owned corporation and is seeking to maximize shareholder wealth.

A) If a firm's managers want to maximize the value of their firm's stock, they should, in theory, concentrate on project risk as measured by the standard deviation of the project's expected future cash flows.

B) If a firm evaluates all projects using the same cost of capital, and the CAPM is used to help determine that cost, then its risk as measured by beta will probably decline over time.

C) Projects with above-average risk typically have higher than average expected returns. Therefore, to maximize a firm's intrinsic value, its managers should favor high-beta projects over those with lower betas.

D) Project A has a standard deviation of expected returns of 20%, while Project B's standard deviation is only 10%. A's returns are negatively correlated with both the firm's other assets and the returns on most stocks in the economy, while B's returns are positively correlated. Therefore, Project A is less risky to a firm and should be evaluated with a lower cost of capital.

E) If a firm has a beta that is less than 1.0, say 0.9, this would suggest that the expected returns on its assets are negatively correlated with the returns on most other firms' assets.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you are an intern with the Brayton Company,and you have collected the following data: The yield on the company's outstanding bonds is 7.75%; its tax rate is 40%; the next expected dividend is $0.65 a share; the dividend is expected to grow at a constant rate of 6.00% a year; the price of the stock is $15.00 per share; the flotation cost for selling new shares is F = 10%; and the target capital structure is 45% debt and 55% common equity.What is the firm's WACC,assuming it must issue new stock to finance its capital budget?

A) 6.89%

B) 7.26%

C) 7.64%

D) 8.04%

E) 8.44%

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If expectations for long-term inflation rose,but the slope of the SML remained constant,this would have a greater impact on the required rate of return on equity,rs,than on the interest rate on long-term debt,rd,for most firms.Therefore,the percentage point increase in the cost of equity would be greater than the increase in the interest rate on long-term debt.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For capital budgeting and cost of capital purposes,the firm should always consider reinvested earnings as the first source of capital- i.e.,use these funds first- because reinvested earnings have no cost to the firm.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The text identifies three methods for estimating the cost of common stock from reinvested earnings (not newly issued stock): the CAPM method,the DCF method,and the bond-yield-plus-risk-premium method.However,only the CAPM method always provides an accurate and reliable estimate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's perpetual preferred stock currently sells for $92.50 per share,and it pays an $8.00 annual dividend.If the company were to sell a new preferred issue,it would incur a flotation cost of 5.00% of the issue price.What is the firm's cost of preferred stock?

A) 7.81%

B) 8.22%

C) 8.65%

D) 9.10%

E) 9.56%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 92

Related Exams