A) $841,000

B) $860,000

C) $883,000

D) $900,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When job order costing is used,costs are accumulated on a job cost sheet.A job cost sheet is used for each unique job,project,or customer.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Commissions expense and advertising expense are included as part of manufacturing overhead and treated as a product cost.Instead of being treated as part of the product cost (included in inventory and,eventually,cost of goods sold),nonmanufacturing costs such as advertising expense and commissions expense are expensed during the period in which they are incurred.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $415,000,and actual labor hours were 21,000.The amount debited to the Manufacturing Overhead account would be

A) $400,000

B) $415,000

C) $420,000

D) $435,750

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Indirect materials are recorded directly on the job cost sheet.Indirect materials are not recorded directly to the job cost sheet or Work in Process Inventory.Rather,these indirect costs are accumulated in the Manufacturing Overhead account and will be assigned to the product using the predetermined overhead rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Overhead costs are underapplied if the amount applied to Work in Process is

A) greater than estimated overhead.

B) less than estimated overhead.

C) greater than actual overhead incurred.

D) less than actual overhead incurreD.Overhead cost is underapplied if the amount applied is less than the actual overhead cost.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $415,000,and actual labor hours were 21,000.Which of the following would be correct?

A) Overhead is underapplied by $15,000

B) Overhead is underapplied by $5,000

C) Overhead is overapplied by $5,000

D) Overhead is overapplied by $15,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $215,000,and actual labor hours were 21,000.The amount credited to the Manufacturing Overhead account would be

A) $200,000

B) $215,000

C) $210,000

D) $225,750

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A marketing consulting firm would most likely use process costing.A marketing consulting firm is more likely to use job order costing,which is used by companies that offer customized or unique products or services.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $415,000,and actual labor hours were 21,000.The amount credited to the Manufacturing Overhead account would be

A) $400,000

B) $415,000

C) $420,000

D) $435,750

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $250,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $225,000,and actual direct labor hours were 19,000.Which of the following would be correct?

A) Overhead is underapplied by $25,000

B) Overhead is underapplied by $12,500

C) Overhead is overapplied by $12,500

D) Overhead is overapplied by $25,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Actual manufacturing overhead costs are debited to the Manufacturing Overhead account.Actual manufacturing overhead costs are recorded on the debit side of the Manufacturing Overhead account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

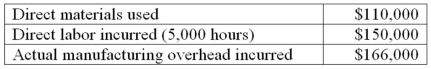

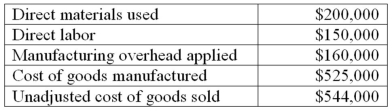

Ragtime Company had the following information for the year: Ragtime Company used a predetermined overhead rate of $35 per direct labor hour for the year.Assume the only inventory balance is an ending Work in Process Inventory balance of $17,000.What was adjusted cost of goods sold?

A) $435,000

B) $426,000

C) $418,000

D) $409,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

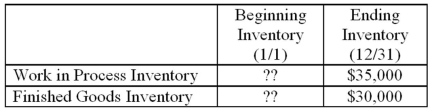

Mendez Inc.had the following information for the preceding year: Additional information for the year is as follows:

What was the beginning Work in Process Inventory balance on 1/1?

A) $49,000

B) $65,000

C) $50,000

D) $69,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recording the purchase of materials that are not traced to any specific job,which of the following is correct?

A) Raw Materials Inventory would be debited

B) Work in Process Inventory would be debited

C) Manufacturing Overhead would be debited

D) Manufacturing Overhead would be credited

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When materials are purchased,which of the following accounts is debited?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Underapplied overhead means

A) too little overhead was applied to raw materials.

B) actual overhead is greater than estimated overhead.

C) finished goods will need to be credited.

D) there is a debit balance remaining in the overhead account.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be used to apply manufacturing overhead to production for the period?

A) Credit to Raw Materials Inventory

B) Credit to Work in Process Inventory

C) Debit to Manufacturing Overhead

D) Credit to Manufacturing Overhead

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

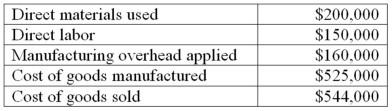

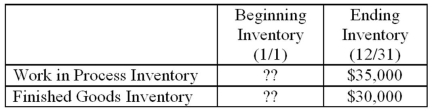

Mendez Inc.had the following information for the preceding year: Additional information for the year is as follows:

What was the beginning Finished Goods Inventory balance on 1/1?

A) $49,000

B) $65,000

C) $50,000

D) $69,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The total manufacturing cost for a job is based on the amount of applied overhead using the predetermined overhead rate.The total manufacturing cost is based on the amount of overhead applied using the predetermined overhead rate.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 112

Related Exams